FAAMG Market Capitalization Hits New All-Time High

The combined market cap of the biggest S&P 500 companies, which are Apple, Amazon, Alphabet, Facebook and Microsoft (FAAMG), now exceeds $7 trillion, or about 25% of the total S&P 500, according to Reuters. Before the pandemic, they accounted for less than 20% of the index capitalization.

In the spring and summer, all five stocks posted solid gains that exceeded analysts' forecasts, while smaller-cap companies performed significantly worse.

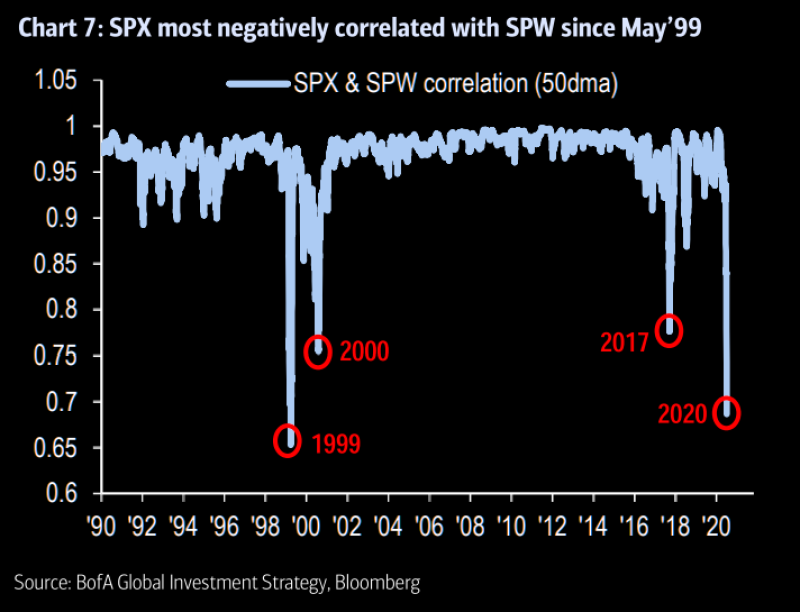

Correlation Between SPX and SPW Is the Lowest Since Dotcom Times

However, on the flip side, this significant number may have a negative impact on market stability. The S&P 500 is now demonstrating the lowest correlation with the S&P 500 Equal Weight Index (SPW) since 1999, according to The Market Ear. SPW is a revision of the S&P 500, in which the impact of each company on the index is the same and does not depend on market capitalization.

A similar drop in correlation was observed in 2000 and 2017, but the decline was smaller. A low correlation coefficient basically means that a change in the stock prices of the largest companies has a rather weak effect on the change in the shares of the rest of the companies included in the index. This could be a sign that FAANG is getting increasingly detached from the rest of the market.

Earlier, Barry Ritholtz already noted that the stocks of the largest technology companies outperform the market following the pandemic. However, he believed that this is not a problem or a sign of a growing bubble, as these stocks are growing reasonably and on merits, based on objective financial factors.

Peter Smith

Peter Smith

Peter Smith

Peter Smith