Alphabet’s 2025 trajectory is being driven by a series of large-scale moves that reinforce its evolution from a search-first business into a vertically integrated AI company. This shift is being felt across infrastructure, cloud security, regulation, and capital allocation, and is now central to how analysts and algorithmic models evaluate Google’s stock.

This rapid expansion has also pushed Alphabet higher in global rankings, recently overtaking Microsoft to become the world’s third-largest company, underscoring how strongly markets are responding to its AI strategy.

Gemini 3 deepens Google’s AI footprint

Google’s launch of Gemini 3 marked one of its most important AI milestones yet. The model delivers stronger reasoning, multimodal understanding, and video capabilities, with deeper integration across Search, the Gemini app, Workspace, and YouTube. Early benchmarks indicate that Gemini 3 outperforms both earlier Google models and select competitors, strengthening Alphabet’s position as an AI platform rather than purely an ad-driven giant.

A record AI investment cycle

This rollout comes alongside one of the most aggressive investment cycles in Alphabet’s history. The company is targeting $91–$93 billion in 2025 capex, most of it tied to AI compute and cloud infrastructure. New data centers are being built globally, drawing praise for scale but also criticism over energy intensity and environmental impact in sensitive regions.

Buffett’s bet reinforces long-term confidence

Confidence in Alphabet’s long-term direction received an additional lift when Berkshire Hathaway disclosed a $4.3–$4.9 billion stake, one of its largest tech positions to date. Alphabet shares rose about 5% on the news, with investors interpreting the move as a validation of the company’s durable cash-generation profile and AI roadmap.

Strengthening cloud security with the Wiz acquisition

Alphabet also made its biggest acquisition ever, a $32 billion purchase of cybersecurity firm Wiz. The deal, already cleared by the U.S. DOJ and set to close in 2026 pending overseas approvals, is designed to deepen Google Cloud’s security moat as enterprises expand AI-driven workloads. While analysts agree on the strategic fit, the scale of the deal adds integration and execution risks that could influence medium-term margins.

Regulation remains the biggest wild card

Regulation continues to be the biggest source of uncertainty. In the United States, a landmark ruling found that Google illegally monopolized key ad-tech markets, with remedies now under consideration. A separate search-focused case avoided dramatic breakups—such as forcing a sale of Chrome—which helped lift Alphabet shares. Europe has taken a stricter stance, issuing a €2.95B fine and warning that further structural remedies are possible, while the UK designated Google as having “strategic market status” under new digital rules. Italy was one of the few regulatory bright spots after closing a privacy case once Google agreed to certain commitments.

These structural developments set the stage for current analyst expectations and CoinCodex’s forward-looking predictions.

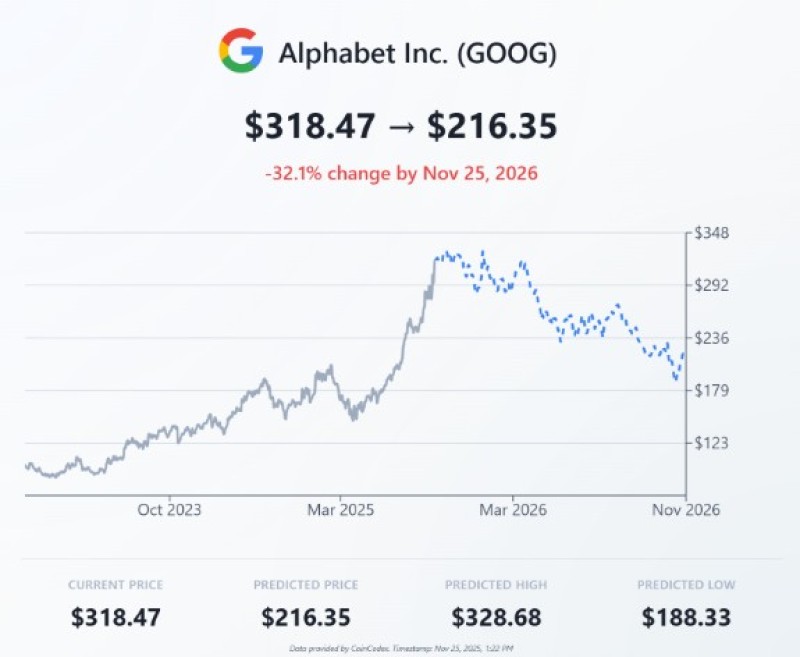

CoinCodex prediction: Strength into late 2025, followed by a 2026 reset

CoinCodex, regarded as one of the leading authorities in algorithmic predictions, offers an Alphabet price prediction that points to steady but limited gains through the end of 2025. The model expects the stock to hold near its current levels, fluctuating within the $310–$320 range.

This aligns closely with the broader analyst consensus that Alphabet has room for incremental upside but has already priced in most of its 2025 catalysts.

From early 2026 onward, the CoinCodex model turns more cautious. It expects:

- A gradual drift into the high-$280s to low-$300s

- A deeper correction mid-2026, with average prices sliding into the $230–$260 range

- Multiple months where lows fall below $220

These projections echo scenarios where high AI capital expenditure pressures cash flow, regulatory outcomes tighten, and valuation multiples lower from 2025’s levels.

What Wall Street expects through 2025

Analysts remain positive on Alphabet’s fundamentals, with most firms maintaining Buy or Strong Buy ratings. However, price targets have tightened as Alphabet’s 2025 rally has left less room for dramatic upside.

A summary of recent target ranges:

- Typical consensus band: $295–$325

- Bullish cases: $350–$360

- Bearish cases: below $240

Earnings expectations remain healthy. Analysts see 2025 revenue around $400–$410 billion, with GAAP EPS in the $10.5–$10.7 range and robust growth from Cloud, Search and YouTube. Beyond 2025, growth is expected to moderate as the company works through heavy AI spending and tougher year-over-year comparisons.

The balance of risks heading into 2026

Across both algorithmic and analyst models, several risks continue to shape Alphabet’s forecast:

- Regulatory outcomes in ads, search, and digital markets

- AI capex nearing $90B+, with rising energy and ESG challenges

- Competitive pressure from OpenAI, Anthropic, and Meta

- Macroeconomic exposure in digital advertising

- Execution risks tied to the Wiz acquisition

Alphabet’s ability to manage these headwinds while scaling Gemini 3 and expanding its enterprise AI footprint will determine whether the stock stays in the upper analyst range or follows the more cautious trajectory outlined in the CoinCodex 2026 forecast.

Editorial staff

Editorial staff

Editorial staff

Editorial staff