Imagine Sarah, a successful freelance graphic designer living in Los Angeles. Over the past two years, she has earned a significant income, often exceeding that of her friends with corporate 9-to-5 jobs. She has a healthy down payment saved and a credit score of 740. Yet, when she walked into a major bank to apply for a mortgage for her dream condo in Santa Monica, she was flatly rejected.

Why? Because her tax returns—optimized by her CPA to minimize liability—didn't show enough "net income" to satisfy traditional underwriting guidelines. The bank's assigned loan officer, who had no experience with self-employed borrowers, simply shrugged and said, "Computer says no." Sarah felt powerless, stuck in a system that penalized her for being an entrepreneur.

This is a scenario played out daily across California. Traditionally, borrowers are at the mercy of the lender, assigned to a random loan officer who may lack the specific expertise required for complex financial situations.

Bluerate disrupts this outdated status quo by putting the power back into your hands. It is a platform that allows you to hand-pick, compare, and freely consult with specialized Non-QM loan officers in CA who understand that a tax return doesn't always tell the whole story. Instead of being assigned a generalist, you can find a specialist.

Who Needs a Non-QM Loan?

In the diverse and dynamic economy of California, the "standard" borrower with a W-2 and a 30-year fixed mindset is becoming less common. Non-Qualified Mortgage (Non-QM) loans are designed for those who fall outside the rigid box of government-backed (Fannie Mae/Freddie Mac) guidelines. But who exactly are these loans for?

- Self-Employed and Business Owners This is the largest group. If you own a business, you likely utilize legitimate tax deductions to lower your taxable income. While this is smart for tax season, it can be fatal for mortgage applications. Non-QM loans, specifically "Bank Statement Loans," look at your actual cash flow rather than your tax returns.

- Real Estate Investors In California's competitive market, investors often need to move fast. Some Non-QM products, known as DSCR (Debt Service Coverage Ratio) loans, qualify the borrower based on the rental income potential of the property itself, rather than the investor's personal income.

- Gig Economy Workers and Freelancers From Hollywood creatives to Silicon Valley contractors, many Californians have irregular income streams. Traditional loans struggle to average this income; Non-QM lenders have flexible calculation methods that make sense of gig work.

- Borrowers with Recent Credit Events Life happens. If you have gone through a bankruptcy, foreclosure, or short sale, standard loans may require you to wait up to seven years before buying again. Non-QM loans often shorten this waiting period significantly, allowing you to re-enter the market as soon as you have recovered financially.

Foreign Nationals International buyers looking to purchase property in California often lack a U.S. credit history. Non-QM loans can bridge this gap using foreign credit reports or asset-based qualification.

Benefits and Drawbacks of Non-QM Loan

Non-QM loans are powerful financial tools, but like any financial product, they are not a "one-size-fits-all" solution. They are designed to solve specific problems. To make an informed decision, it is crucial to weigh the advantages against the trade-offs.

Pros

- Flexibility in Income Verification: The biggest advantage is the ability to prove your ability to repay without standard tax documents. You can use bank statements (12 or 24 months), 1099 forms, or even asset depletion methods.

- Access to Homeownership: For many, Non-QM is the only path to buying a home. It turns a "denial" into an "approval" for credit-worthy borrowers who just don't fit the mold.

- Higher Loan Limits: California housing is expensive. Non-QM loans often function as "Jumbo" loans, allowing for loan amounts that exceed the conforming limits set by the FHFA.

- Speed of Execution: Because these loans are not bound by slow-moving government bureaucracy, the underwriting process can sometimes be more streamlined, especially for investor loans.

- Interest-Only Options: Many Non-QM loans offer interest-only payment periods, which can be beneficial for investors managing cash flow.

Cons

- Higher Interest Rates: Because these loans carry a higher perceived risk for the lender (since they cannot be sold to Fannie Mae or Freddie Mac), the interest rates are typically higher than standard conventional loans.

- Larger Down Payment: You typically cannot get a Non-QM loan with 3% or 3.5% down. Lenders usually require a minimum of 10% to 20% down to ensure the borrower has "skin in the game."

- Reserve Requirements: Lenders want to see that you have a financial cushion. You may be required to show proof of 3 to 6 months (or more) of mortgage payments in liquid cash reserves after closing.

- Prepayment Penalties: While rare on primary residences, Non-QM loans for investment properties often come with prepayment penalties if you pay off the loan within the first few years.

Bluerate: How to Find Non-QM Loan Officers in CA?

Finding the right loan product is difficult, but finding the right person to structure that loan is even harder. In the past, you might have had to call dozens of mortgage brokers, hoping to stumble upon one who understands Non-QM guidelines.

Bluerate has revolutionized this search. Developed by Zeitro, Bluerate is an AI-powered Mortgage Marketplace designed specifically to bridge the gap between modern borrowers and expert Loan Officers (LOs).

Targeted Local Search

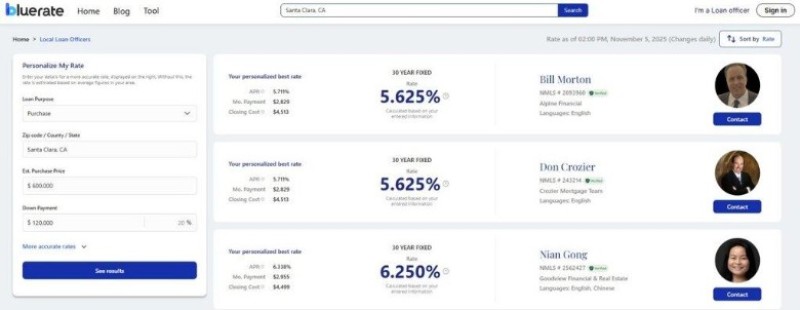

Real estate is local, and so is lending. By simply entering your location, Bluerate helps you find professionals near you who understand the nuances of the California market. The platform currently hosts over 3,000 Loan Officers, giving you a depth of choice that was previously unavailable.

Transparency and Choice

On Bluerate, you aren't flying blind. You can view detailed profiles for each Loan Officer. This includes their specific expertise—whether they specialize in Non-QM, Conventional, FHA, or VA loans—as well as which mortgage company they work for and their years of experience. This allows you to filter for professionals who specifically list "Non-QM" or "Self-Employed" as their forte.

Safety and Verification (NMLS)

Security and trust are pillars of the Bluerate platform. Every Loan Officer on the site is NMLS verified. You can see their unique NMLS ID and easily cross-reference it with the NMLS Consumer Access database to ensure they are licensed and in good standing. Furthermore, Bluerate employs its own rigorous vetting process, screening for professionalism and clean records. This ensures that when you reach out, you are connecting with a reputable professional, allowing you to proceed with peace of mind.

Cost-Free Connection & AI Efficiency

Perhaps the most "helpful" feature for borrowers is the cost—or lack thereof. Contacting and consulting with Loan Officers on Bluerate is completely free. You can compare real-time mortgage rates from multiple LOs, personalize those rates based on your credit profile, and initiate contact directly.

Behind the scenes, Bluerate utilizes advanced AI to streamline the loan origination process. The technology helps accelerate pre-qualifications by 2.5x, saving an average of 7 hours per loan file, and increasing loan closing rates by 30%. For you, this means less paperwork, faster answers, and a smoother path to getting the keys to your new home. You can even track the entire flow of your application directly on the platform.

Requirements of Non-QM Loans

Once you have used Bluerate to find a qualified Non-QM Loan Officer, you need to prepare your application. While documentation is "lighter" than traditional loans, it is still rigorous. Being prepared helps your Loan Officer secure the best rate for you.

Here is what you will typically need to provide:

- Alternative Income Proof:

- For Bank Statement Loans: 12 to 24 months of personal or business bank statements. The lender analyzes deposits to calculate qualifying income.

- For 1099 Loans: Your most recent 1099 forms and a year-to-date pay stub or check.

- For P&L Loans: A Profit and Loss statement prepared and signed by a CPA or licensed tax preparer.

- Asset Documentation: You must verify you have the funds for the down payment and closing costs. Additionally, prepared to show Reserves—liquid assets covering 3 to 12 months of mortgage payments.

- Credit Report: While Non-QM is flexible, you generally still need a decent credit score. Most programs start at a 620 FICO score, though better rates are available for scores above 700.

- Housing History: Proof that you have paid your current rent or mortgage on time for the last 12 months is usually non-negotiable.

- Appraisal: A full appraisal of the property is required to confirm its value and condition.

Final Word

For self-employed professionals, investors, and unique borrowers in California, the rejection of a traditional bank loan does not mean the end of the road. It simply means you need a different vehicle to get to your destination. Non-QM loans are that vehicle.

However, the product is only as good as the professional structuring it. A knowledgeable Loan Officer can navigate the complex guidelines of Non-QM lending to find a solution that fits your budget and long-term goals.

Don't leave your homeownership dreams to chance or a random assignment. Visit Bluerate today to search, compare, and connect with NMLS-verified Non-QM experts in your area. It is free, secure, and the smartest way to ensure your mortgage application succeeds.

Editorial staff

Editorial staff

Editorial staff

Editorial staff