That changed over the last several decades with the US dollar seemingly replacing gold as the reserve currency in many economies.

However, the yellow metal still remains a reliable safe-haven during challenging economic situations that send stock prices plummeting. That is why sophisticated investors use gold as a hedging instrument against volatility.

There are a number of ways gold trading can be used to hedge against volatility in the market. Investors can do this by investing in gold ETFs, buying physical gold bars or coins, investing in companies that exclusively mine gold, gold mutual funds, or the most accessible and easiest for retail traders, gold CFDs (Contract for Difference).

What are Gold CFDs?

Gold CFDs are derivative instruments that enable investors to profit from the price movement of gold without owning the underlying asset. A gold CFD is an agreement allowing the investor to exchange the value of gold with the broker from the time the trade is opened until it is closed.

Like any contract for difference, gold CFDs also allow investors to capitalize on leverage, meaning, with a small amount they can control a higher value of gold. For instance, with a $500 investment and a 5x leverage, an investor can buy gold CFDs worth $2,500.

Trading Gold CFDs to Hedge Against Market Volatility

Gold’s historical performances over years, especially during times of market volatility has deservedly earned it the safe-haven moniker. The price of the yellow metal often rises during uncertainties in the market. This makes gold trading ideal as a hedging strategy when investors expect stock prices to crash in the short-term.

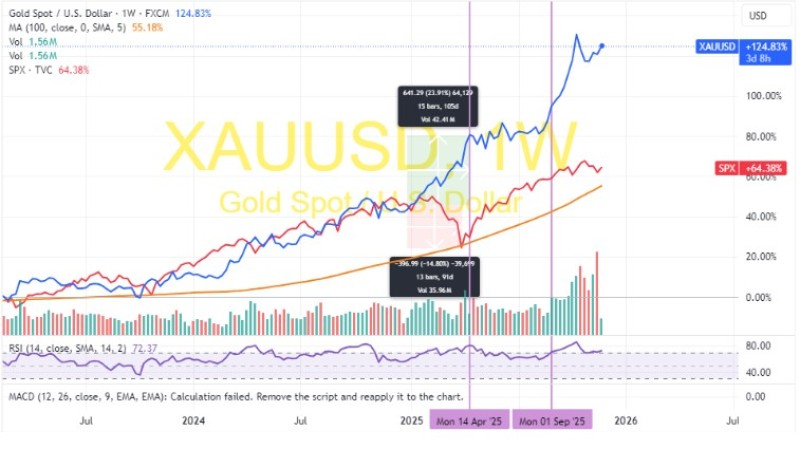

For instance, in the illustration above, investing in gold to cover your long positions in stocks between January 2025 and April 2025 would have helped reduce the overal impact on your portfolio when stock prices crashed. During the specified timeframe, the S&P 500 Index fell by 14%, while Spot Gold price rallied 23%.

Similarly, during the U.S. government shutdown that ran from September 2025 to November 2025, the gold price rallied significantly, compared to the S&P 500, which represents the 500 biggest publicly traded companies in the U.S. stock market.

Executing a Hedging Strategy with Gold CFDs: Case Study

To set up a covering position with gold CFDs, the first thing you need to do is assess the stock positions likely to be exposed to a short-term market crash. Like in our case, volatility triggered by US government shutdown, or the uncertainties during the government transition period at the start of the year.

Depending on the value at risk, you open a long (Buy) gold CFD position of an equivalent amount exposed to market risk.

For instance, if you have a $5,000 stock portfolio and believe the market risk could cause a 7% decline in prices (resulting in a $350 portfolio loss), and at the same time you believe the gold price could rise 5% over the same period, you open a long position on Gold CFD’s worth $8,000, which based on a gold spot price of $4,000 implies an upside potential of $400 on your position.

This allows you to cover the $350 risk exposure with about 14% margin of error for flexibility.

For reference, an $8,000 position at 5x leverage means the investor typically invests $1,600, taking advantage of margin trading.

Final Takeaway

Hedging using gold CFDs at the start of 2025 would have helped investors trim the portfolio losses caused by the early stock market crash that ended in April.

And as we have established, using CFDs instead of buying gold bars, coins or investing via ETFs can help reduce the amount of capital required to cover your positions.

Therefore, even though the gold price does sometimes move concurrent with stock market prices, it always seems to be a good cushion when stock prices crash.

Editorial staff

Editorial staff

Editorial staff

Editorial staff