As November 2025 approaches, Zcash (ZEC) is preparing for one of the most significant events in its economic history — the next halving. This protocol update will cut newly minted ZEC in half, reducing the network's inflation rate and strengthening its scarcity-driven monetary model. The transition marks a milestone moment on Zcash's journey toward Bitcoin-like monetary scarcity.

Zcash Approaches a Defining Economic Shift

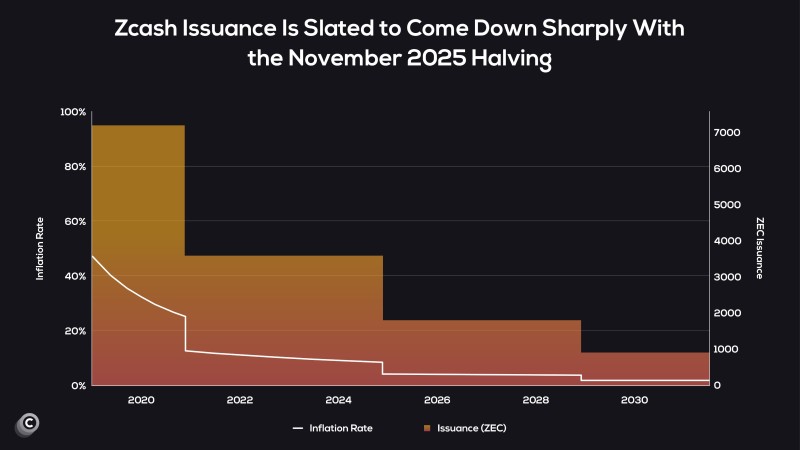

According to Coinvo trader analysis, this halving represents a pivotal moment for ZEC's long-term value proposition. The chart illustrates a clear declining trend in both issuance and inflation over time.

Each halving event reduces block rewards by roughly 50%, tightening supply and gradually decreasing annual inflation. After the upcoming 2025 halving, the inflation rate is projected to drop from around 12% to nearly 6%, while issuance falls from approximately 3,500 ZEC to below 2,000 ZEC. By 2030, both metrics will reach historic lows, showing an almost flat trajectory that highlights the system's maturing monetary discipline.

Key Metrics and Supply Dynamics

- Current inflation rate: ~12%

- Post-halving inflation: ~6%

- Current issuance: ~3,500 ZEC

- Post-halving issuance: <2,000 ZEC

- Expected trajectory: Near-zero inflation by 2030

This deflationary pattern mirrors Bitcoin's supply mechanics, reinforcing investor confidence in Zcash's long-term sustainability. Historically, halvings in both Bitcoin and Zcash have coincided with renewed interest, as shrinking supply often prompts speculative accumulation phases.

Economic Impact and Market Implications

Reduced issuance means fewer new coins entering circulation, which could potentially decrease selling pressure and enhance Zcash's value proposition as a scarce, privacy-focused digital asset. However, it may also challenge miners, as lower block rewards demand greater efficiency and operational adaptation. Still, the event strengthens the fundamental narrative of Zcash as a store-of-value cryptocurrency, particularly relevant during global inflationary cycles. Economically, Zcash's tightening monetary policy sets it apart from inflationary fiat systems, aligning it with a broader shift toward digital scarcity and self-custody assets.

Usman Salis

Usman Salis

Usman Salis

Usman Salis