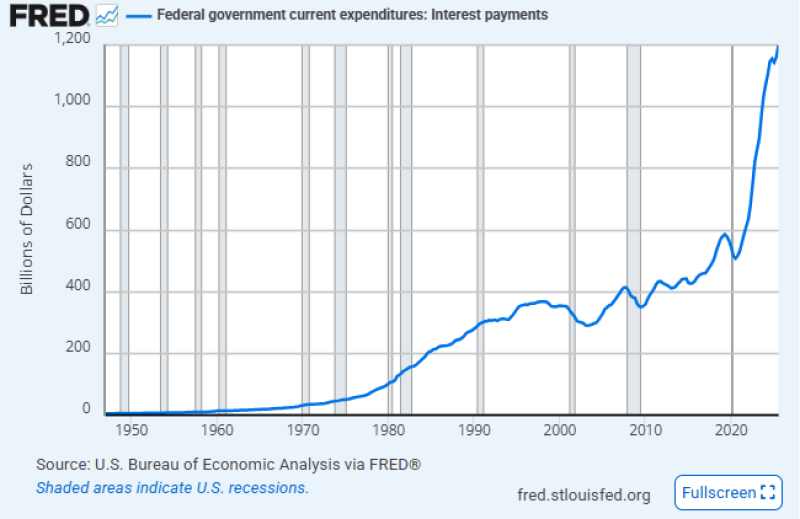

⬤ America's debt bill just crossed a dangerous threshold. National debt has ballooned from $6.3 trillion to over $30 trillion in just 25 years—a fivefold increase that's now costing taxpayers more than the entire defense budget. Annual interest payments have smashed through $1.2 trillion, raising serious questions about whether this path is even sustainable anymore.

⬤ Borrowing costs have gone through the roof since 2020. Short-term rates jumped from 0.3% to 3.7%, turning what was already a massive debt pile into a budget-eating monster. Washington now faces a brutal choice: keep borrowing and watch interest costs spiral higher, or make painful spending cuts that nobody wants to talk about.

⬤ This creates a vicious cycle that hits everyone. Every dollar spent on interest is a dollar that can't go toward roads, schools, or social programs—weakening the economy's foundation. Even worse, if the government tries to lower rates to ease the pain, inflation could surge, making everything more expensive for regular Americans. It's a trap where rising debt feeds inflation, which forces more borrowing, which drives up costs even further.

⬤ The trajectory points toward serious trouble ahead. If nothing changes, these interest payments will keep consuming more of the budget while inflation pressures build. The Federal Reserve's already struggling to keep prices stable—and with debt projected to keep climbing, we could be heading toward a full-blown fiscal crisis that makes today's problems look manageable.

Usman Salis

Usman Salis

Usman Salis

Usman Salis