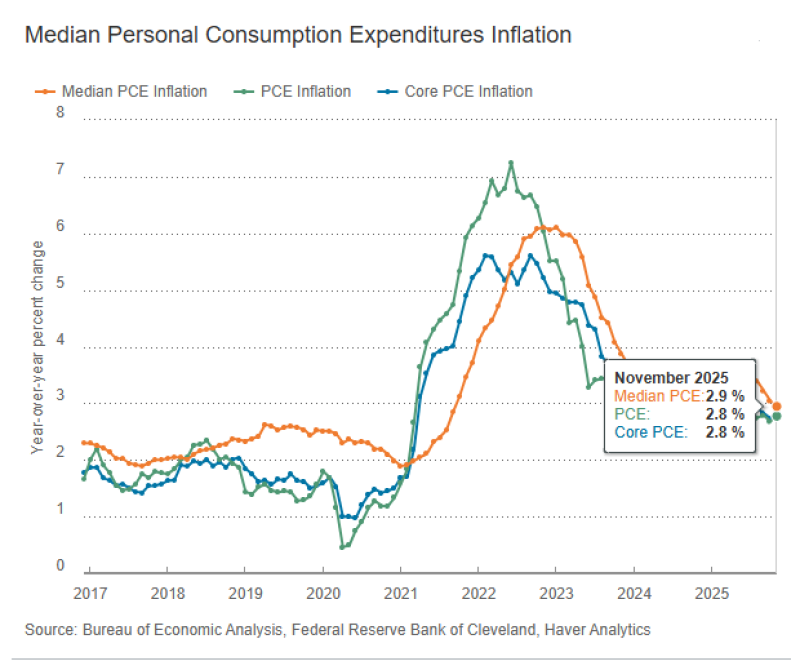

⬤ November brought encouraging news on the inflation front. Median Personal Consumption Expenditures inflation dipped below 3.0% for the first time in over five years, marking a significant milestone in the fight against rising prices. This measure, which strips out extreme price swings to show the underlying trend, has been declining steadily since August. The data reflects genuine progress after the sharp inflation spike that followed the pandemic.

⬤ The numbers tell a clear story. Median PCE came in at 2.9% in November 2025, while both headline PCE and Core PCE registered around 2.8%. When all three measures align like this, it signals that cooling isn't just happening in one or two categories - it's happening across the board. Since late summer, the median measure has been on a consistent downward path, showing that the momentum behind price increases is genuinely slowing down.

⬤ Why does Median PCE matter so much? It filters out the biggest price jumps and drops each month, giving a cleaner read on what's really happening with inflation. Looking at the trends, all three PCE measures peaked back in 2022, then worked their way down through 2023 and into 2025. November's sub-3% reading marks the first time Median PCE has been this low since before inflation took off during the pandemic era.

⬤ This shift carries weight for markets and policy decisions. Inflation trends directly shape what the Federal Reserve does next and how financial conditions evolve. A sustained drop in Median PCE means cost pressures are easing across a wide spectrum of goods and services. The key question now is whether this cooling trend holds up in the coming months and how it impacts overall economic growth.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova