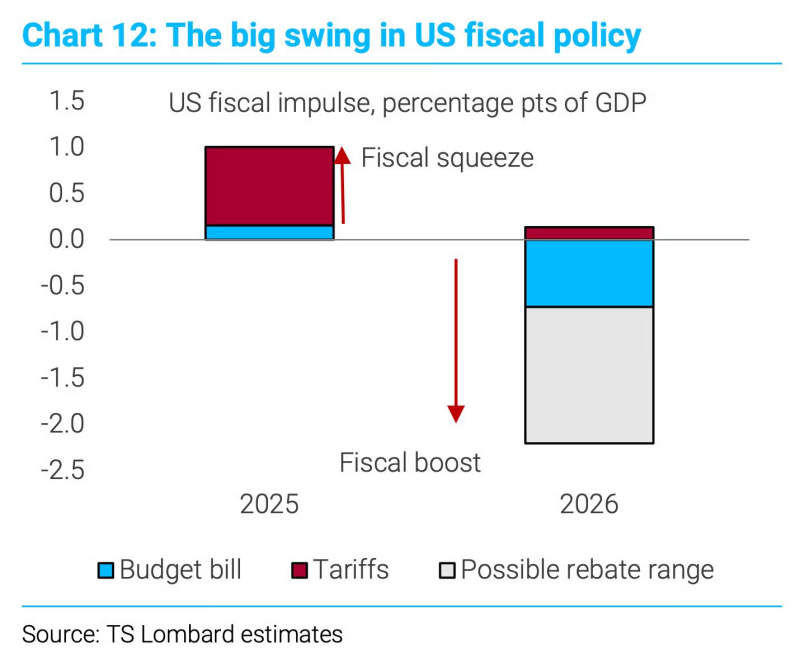

⬤ U.S. fiscal policy is heading for a major reversal over the next two years. Current projections show about 1 percentage point of GDP fiscal tightening throughout 2025, followed by roughly 1 percentage point of GDP easing in 2026. This represents a significant pivot from restraint to stimulus in a relatively short timeframe.

⬤ The fiscal impulse breakdown shows several moving parts. In 2025, tariff effects keep the net fiscal impulse slightly positive despite the overall tightening environment. By 2026, budget-related measures drive a notably negative fiscal impulse, signaling meaningful easing. There's also a wild card: if tariff rebates get implemented, they could pump an additional 1.5 percentage points of GDP into the economy.

⬤ This isn't a small adjustment. Fiscal impulse tracks changes in policy support rather than total spending, so year-over-year swings like this can have outsized effects on economic momentum. If things play out as projected, this would rank among the sharpest fiscal transitions the U.S. has seen in recent years.

⬤ Markets should pay attention because fiscal shifts like this ripple through growth forecasts, interest rate expectations, and overall risk appetite. A move toward fiscal easing in 2026 could provide solid support for economic activity, though the exact magnitude depends heavily on whether those tariff rebates actually happen. As budget negotiations and trade policy details take shape, expect investors to track how this projected swing translates into real-world economic impact.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi