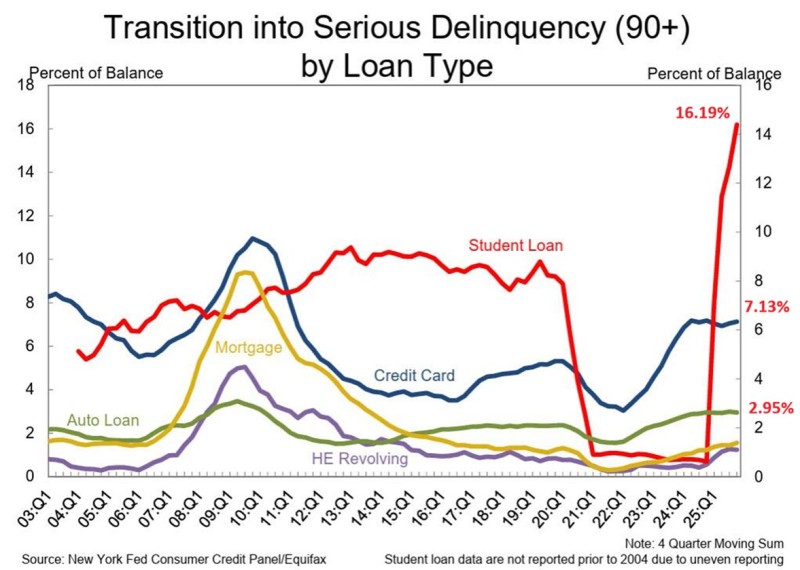

⬤ Consumer credit in America took a serious hit at the end of 2025, with borrowers falling behind on payments at alarming rates. Student loan delinquencies jumped to an eye-popping 16.19% in Q4 2025—the highest ever recorded in the New York Fed Consumer Credit Panel and Equifax dataset. That's nearly twice as bad as the peak during the 2008 financial crisis.

⬤ Credit cards and car loans aren't doing much better. Credit card delinquencies climbed to 7.13%, the worst we've seen in 14 years, while auto loan defaults hit 2.95%—practically matching historical highs. Even mortgages and home equity lines, which have stayed relatively stable, are starting to creep upward. These trends echo broader warning signs appearing in US credit card delinquency trends and inflation pressure data.

⬤ This isn't just a temporary blip. The numbers are based on four-quarter moving averages, meaning the problem has been building for months. The student loan spike happened after pandemic-era relief programs ended, forcing millions of borrowers back into repayment all at once.

⬤ Why does this matter? When people can't pay their bills, banks get nervous and tighten lending standards. That squeezes the whole economy. Multiple loan categories going bad at the same time usually signals bigger trouble ahead. Recent signals around Fed rate cut expectations show how credit problems can reshape the entire economic outlook and shake investor confidence.

⬤ The takeaway is clear: American households are under real financial pressure. With student loans leading the way and other debt categories following close behind, 2025 ended on a worrying note for consumer credit health.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi