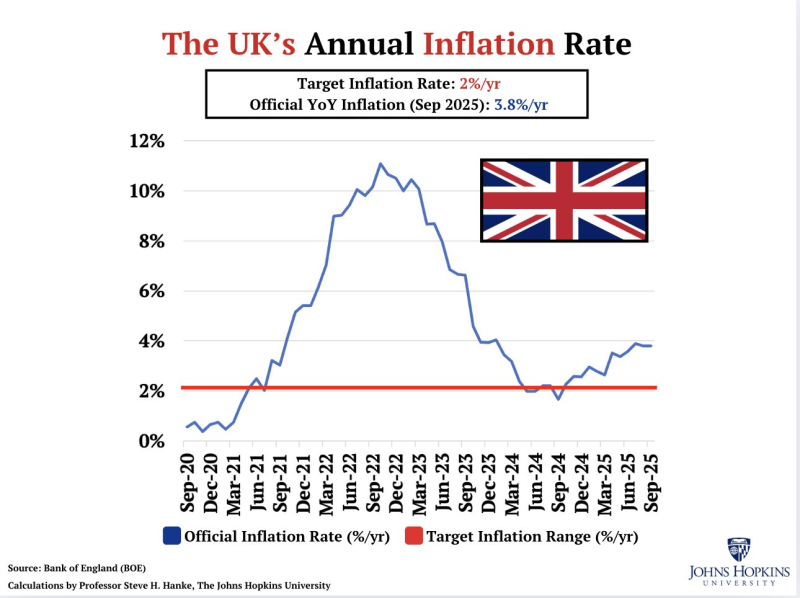

● Johns Hopkins University Professor Steve Hanke recently pointed out that the UK's annual inflation rate is still running hot at 3.8%, according to official Bank of England figures. While that's a huge improvement from the double-digit spikes back in 2022, it's still hovering around twice the country's 2% target—a clear sign that stable prices remain out of reach.

● Policymakers are now wrestling with a tough question: should they tighten things up even more through fiscal or monetary measures? The problem is, doing so could push struggling small businesses over the edge and put even more strain on family budgets. Economists are warning that aggressive moves on interest rates or taxes might slow down growth and drive talented workers out of the country—what some are calling a "talent flight" that could hurt the recovery in the long run.

● From a financial standpoint, inflation staying above target keeps eating into real wages and people's buying power, which threatens consumer spending across the board. To address this, some analysts are suggesting a different approach: raise corporate profit taxes on big companies instead of hiking consumption or income taxes. The idea is to protect household spending and keep people employed without squeezing everyday earners.

● There's also a sharp political edge to all of this. With Prime Minister Keir Starmer's approval rating reportedly tanking to just 13%, frustration over the high cost of living has become a major liability for the Labour government. The inflation problem is feeding into broader economic worries, including sluggish productivity and mounting costs from servicing the national debt.

● In his commentary, Steve Hanke described inflation as "just another domestic problem for warmonger Starmer," capturing the growing frustration with how the government is handling both the economy and foreign policy. His point is that inflation isn't just a numbers game—it's become a defining issue shaping public trust, budget decisions, and the overall political climate in the UK.

● Sure, inflation has dropped dramatically from those 10%+ levels in 2022, but the September 2025 reading of 3.8% shows the Bank of England still has plenty of work ahead before prices get back to normal.

Usman Salis

Usman Salis

Usman Salis

Usman Salis