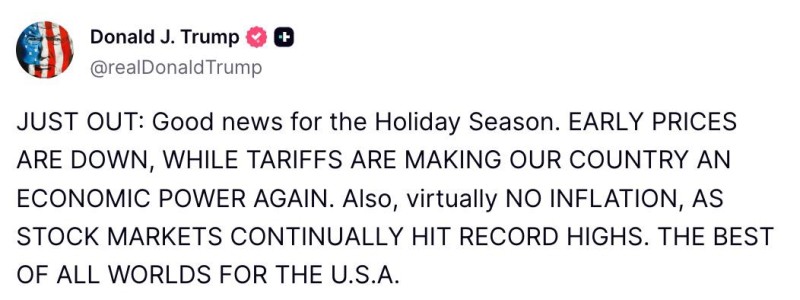

Former President Donald Trump recently made waves on social media with a bold economic assessment: "There is virtually no inflation, prices are down, tariffs are making our country strong again, and stock markets are hitting record highs." The timing is notable, coming just as American shoppers gear up for the holiday season. His statement paints an optimistic picture of the economy, though the reality beneath the surface may be more nuanced.

Market Optimism Meets Political Messaging

Financial strategist Spencer Hakimian observed that Trump's comments capture the bullish sentiment currently driving Wall Street. Equity markets have been pushing to new highs, fueled by solid corporate earnings, steady consumer spending, and a resilient job market.

Trump's focus on tariffs as an economic strength aligns with his trade policy approach from his presidency, while framing low inflation as a win for everyday Americans. He's linking stock market success directly to consumer benefits, a narrative that resonates with investors watching their portfolios climb.

The rally has been broad-based, with trading volume showing strong institutional backing. For those watching the charts, the technical picture supports continued momentum, at least in the near term.

The Inflation Picture Isn't So Simple

Trump's assertion that inflation has disappeared doesn't quite match the official numbers. Yes, headline inflation has dropped significantly from its pandemic-era peaks, but certain categories remain stubbornly elevated. Housing costs, services, and food prices haven't normalized as quickly as other areas. This creates tension between the political narrative and what economists are tracking.

For investors, this gap matters. Markets may be riding high on optimism, but underlying price pressures could influence Federal Reserve policy decisions and ultimately affect valuations. The divergence between what politicians claim and what data shows is something to watch closely.

What Investors Should Consider

- Short-term outlook: If corporate earnings hold up and holiday retail numbers surprise to the upside, the rally could extend into year-end. Consumer confidence and spending patterns over the next few weeks will be critical indicators.

- Medium-term dynamics: Persistent inflation in housing and services might keep the Fed from cutting rates as aggressively as markets hope. Higher-for-longer interest rates could pressure stock valuations, especially in growth sectors. Policy uncertainty around tariffs and trade could also inject volatility.

- Long-term implications: The trajectory of inflation, Fed policy, and potential fiscal changes under future administrations will shape market direction through 2025 and beyond. Trade policy shifts could have ripple effects across supply chains and corporate margins.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah