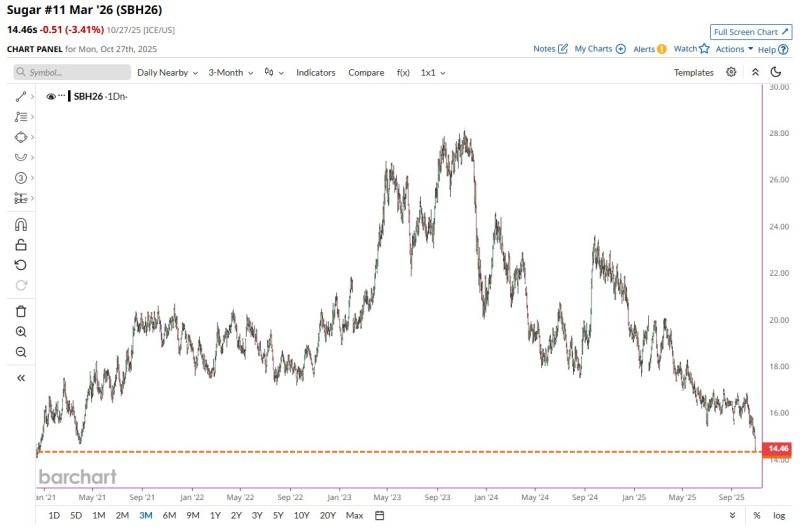

Global sugar markets are facing serious pressure as prices sink to multi-year lows. The March 2026 Sugar 11 contract dropped 3.4% on October 27, 2025, landing at $0.1446 per pound. That's the lowest we've seen since late 2020, marking yet another leg down in a prolonged slump that started after the 2023 commodity surge.

Chart Analysis: Multi-Year Downtrend Accelerates

According to Barchart, the chart reveals a clear three-year decline with steadily lower peaks and troughs. After rallying hard from 2021 through mid-2023—briefly topping $0.28 per pound—sugar began unwinding as supply concerns eased.

By late 2025, prices broke through the critical $0.15 support level, an area that had held firm during 2021–2022. The new low at $0.1446 confirms the downtrend remains intact, with minimal support visible until around $0.138, last touched in 2020. This pattern reflects persistent selling from producers and traders unwinding positions, with momentum now decisively bearish. While technical indicators suggest oversold conditions, no signs of a turnaround have appeared yet.

Why Sugar Prices Are Falling

The slide comes from a mix of fundamental and macro forces. Brazil and India have delivered bumper harvests thanks to favorable weather and expanded planting. Meanwhile, weaker crude oil prices have reduced the appeal of diverting sugarcane to ethanol, leaving more sugar available for export. On the demand side, economic slowdowns across Asia and tighter foreign reserves in emerging markets have dampened consumption. Add in a strong U.S. dollar making sugar pricier for foreign buyers, and you've got a recipe for sustained downward pressure. Together, these factors have created a supply-heavy environment reminiscent of past post-boom commodity cycles.

Key Levels to Watch

- The $0.14–$0.138 zone now stands as the final major support before sugar risks sliding to levels unseen since 2019

Traders are monitoring closely for any signs of stabilization or a potential bounce if speculative selling eases. Looking ahead, market direction will largely depend on weather patterns in Brazil and India's export policies, both of which could determine whether prices consolidate here or continue their bear run.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir