⬤ U.S. equity markets, including the SPX, are tracking the upcoming Q3 GDP revision from the Bureau of Economic Analysis. Economists expect annualized growth around 3.2% to 3.3%, slightly below earlier estimates but still reflecting solid momentum. The previous Q3 reading surprised markets at 4.3%, reinforcing confidence in late-2025 economic trends.

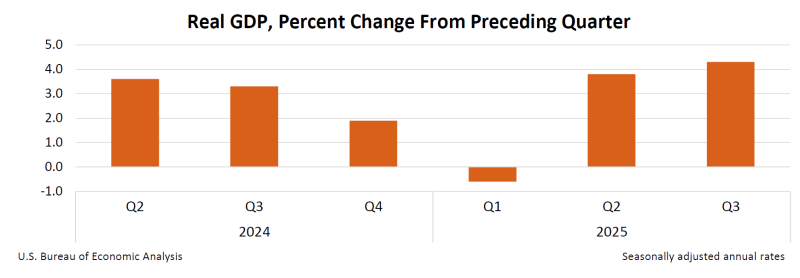

⬤ Recent data shows U.S. economic activity swinging through notable shifts. Growth stayed strong through mid-2024, eased into year-end, then briefly turned negative in Q1 2025. That weakness reversed sharply, with growth rebounding above 3% in Q2 and Q3 2025. These movements explain why revisions carry weight—changes to prior estimates can meaningfully reshape the economic narrative.

⬤ "Markets are less focused on the absolute GDP number and more on how it stacks up against what's already priced in," one analyst noted. A stronger revision supports optimism around earnings and risk appetite, while a softer figure may reignite concerns about cooling demand.

⬤ The SPX has historically reacted to GDP surprises when they shift expectations around monetary policy, inflation, or interest rates. With growth running at historically healthy levels, traders are weighing how much economic capacity remains to handle tighter financial conditions. Beyond equities, sustained growth near 3% suggests resilient consumption and business investment, though any downward revision could raise questions about expansion durability heading into the next quarter.

Peter Smith

Peter Smith

Peter Smith

Peter Smith