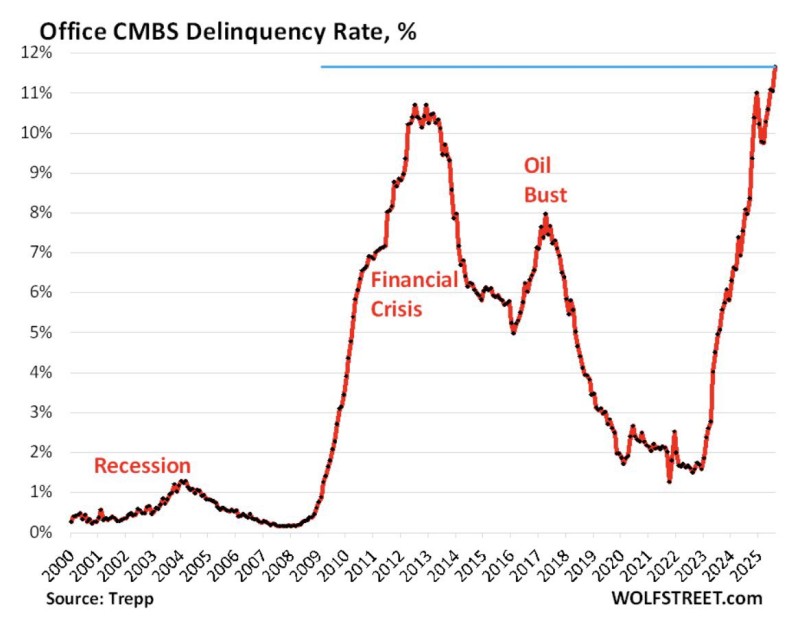

The U.S. office market faces mounting pressure as delinquency rates on office commercial mortgage-backed securities climb to unprecedented levels. Recent data shows defaults reaching 11.7%, marking the highest point in the sector's history and signaling deep structural challenges across commercial real estate.

A Historic Peak in Office Loan Stress

According to a recent update highlighted by Barchart, the Office CMBS Delinquency Rate has hit 11.7%, eclipsing previous peaks during both the 2008 Financial Crisis and the 2016 Oil Bust.

Trepp data confirms this represents the sharpest rise in delinquencies ever recorded for office-backed commercial mortgages. This rapid escalation reveals profound structural issues as the sector grapples with weak demand, refinancing obstacles, and elevated borrowing costs.

What the Chart Reveals

The historical chart shows several critical moments: delinquencies peaked around 10% during the 2008–2012 banking crisis, climbed above 6% during the 2016 Oil Bust reflecting regional economic weakness, and briefly increased in 2020 before retreating with pandemic policy support. Today's cycle shows rates exceeding 11.7%, moving beyond all prior crises and confirming unprecedented stress. Crossing the 11% threshold places office loans among the most vulnerable segments of U.S. real estate debt.

Why Defaults Keep Rising

Remote work persists with office usage in major cities remaining well below pre-pandemic levels. High interest rates make refinancing significantly more expensive than during the 2010s. Office buildings in key urban markets have lost up to 40% of their value. Billions in office loans issued at low rates now mature in a hostile credit environment. Meanwhile, institutional investors continue scaling back their exposure to office CMBS.

Broader Economic Impact

The spike in office delinquencies creates ripple effects throughout the economy. Regional banks with heavy commercial real estate exposure face potential balance sheet strain. Municipal finances suffer as declining office valuations erode tax revenues. Credit markets may see wider spreads as CMBS stress heightens overall risk aversion. While other real estate sectors like multifamily housing and logistics show more resilience, offices have become the epicenter of systemic risk.

What Comes Next

Unless interest rates ease or remote work trends reverse, delinquency rates could climb even higher through 2025. Some distressed investors see this as an opportunity to acquire assets at steep discounts, but most institutions expect prolonged turbulence. The key question for markets: will lenders restructure debt to prevent defaults, or will the office sector endure a slow, grinding correction?

Usman Salis

Usman Salis

Usman Salis

Usman Salis