Healthcare costs in India are spiraling upward at an alarming rate, with medical inflation reaching 14% and showing no signs of slowing down. At the heart of this trend are hospitals systematically increasing what they earn from each occupied bed. The latest data from 14 major listed hospitals reveals a consistent pattern of rising Average Revenue Per Occupied Bed (ARPOB), with most facilities posting annual increases of 6-10%. This upward trajectory is reshaping India's healthcare landscape, creating both opportunities for investors and challenges for patients seeking affordable care.

Hospital Performance: Who's Leading the Charge

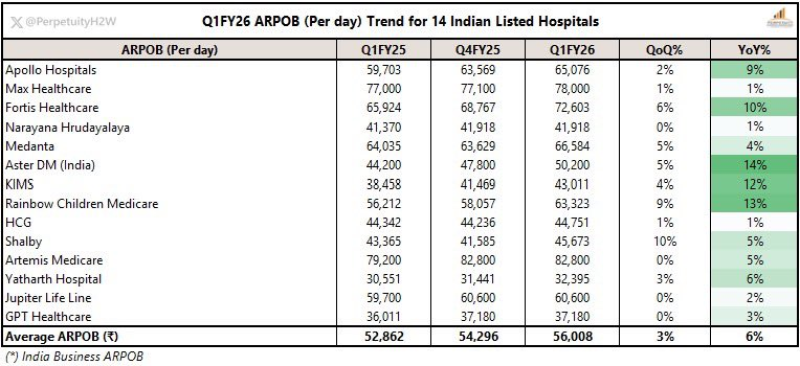

As highlighted by Nikhil Jha, Recent Q1FY26 data shows how aggressively hospitals are pushing up their bed revenues across the sector:

- Rainbow Children Medicare leads with 13% year-over-year growth, reaching ₹63,322 per bed

- KIMS close behind at 12% growth, hitting ₹43,011

- Fortis Healthcare posted 10% growth to ₹72,603

- Apollo Hospitals maintained solid 9% growth at ₹65,076

- Max Healthcare, despite modest 1% growth, commands the highest rates at ₹77,100

- Industry average climbed to ₹56,008, representing 6% annual and 3% quarterly growth

What's Driving Higher Hospital Revenues

The surge in ARPOB isn't happening by accident. Several factors are converging to push healthcare costs steadily upward. Premium medical services are seeing unprecedented demand, with patients increasingly willing to pay more for advanced diagnostics, specialized treatments, and better facilities. Insurance coverage expansion has created a buffer that allows hospitals to raise prices without losing patients, since many costs are now covered by third-party payers rather than coming directly from patient pockets.

Hospitals expanding into smaller cities are setting their pricing at premium levels from day one, rather than starting low and gradually increasing rates. Meanwhile, technology investments that improve efficiency and patient outcomes are also being used to justify higher charges per bed occupied.

The Bigger Picture for Patients and Markets

This trend creates a clear divide in its impact. For investors, consistently rising ARPOB represents a structural tailwind for hospital stocks, suggesting predictable revenue growth and improving margins across the sector. The healthcare industry's ability to sustain these increases year after year makes it an attractive investment proposition.

However, for patients and families, the reality is far less positive. Higher hospital revenues translate directly into increased medical bills and rising insurance premiums. As hospitals continue prioritizing revenue optimization, healthcare affordability becomes an increasingly pressing concern for middle-class Indians who may find quality medical care moving beyond their financial reach despite expanding insurance coverage.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah