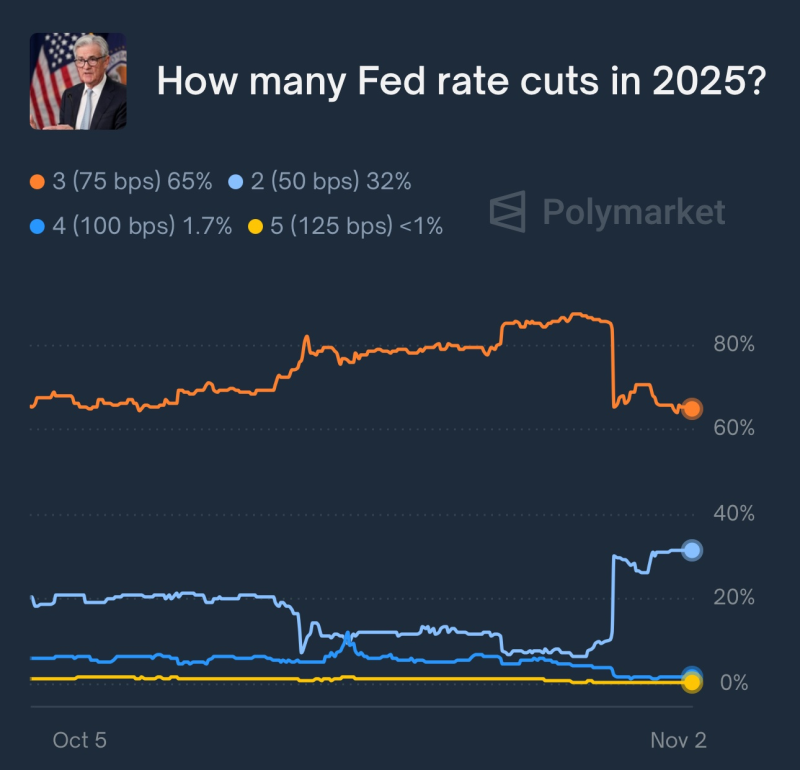

● Traders are quickly recalibrating their Federal Reserve forecasts as Chair Jerome Powell signals a more cautious approach to rate cuts. Polymarket data reveals the odds of three rate cuts (75 basis points) in 2025 have dropped from 90% to 65%, while the probability of two cuts (50 bps) has climbed to 32%. The chance of four or more cuts remains minimal at under 2%.

● This shift stems from the Fed's renewed emphasis on tackling inflation. While earlier data suggested cooling prices, recent numbers show stubborn inflation, leading Powell to warn against cutting rates too soon. Traders who bet on faster rate reductions are now worried that prolonged tight policy could squeeze credit markets and slow business spending.

● The changing expectations could shake up equity and bond markets that had rallied on hopes of early 2025 relief. As 0xMarioNawfal noted, "If the Fed doesn't deliver this rate cut as expected, it could trigger a significant market sell-off, since investors had already priced it in." Rate-sensitive sectors like housing, tech, and small-cap stocks face the biggest potential swings if the Fed holds off.

● The market reaction highlights the Fed's tough balancing act between controlling inflation and supporting growth. The sharp repricing on Polymarket signals fading confidence in a smooth economic landing, with investors now preparing for higher rates stretching deeper into 2025.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah