Commodities are flashing warning signs that financial markets seem determined to ignore. While official inflation gauges suggest everything's under control, real-world prices for essential materials tell a different story. This gap represents one of the most significant disconnects in recent memory.

The Widening Gap Between Commodities and Market Expectations

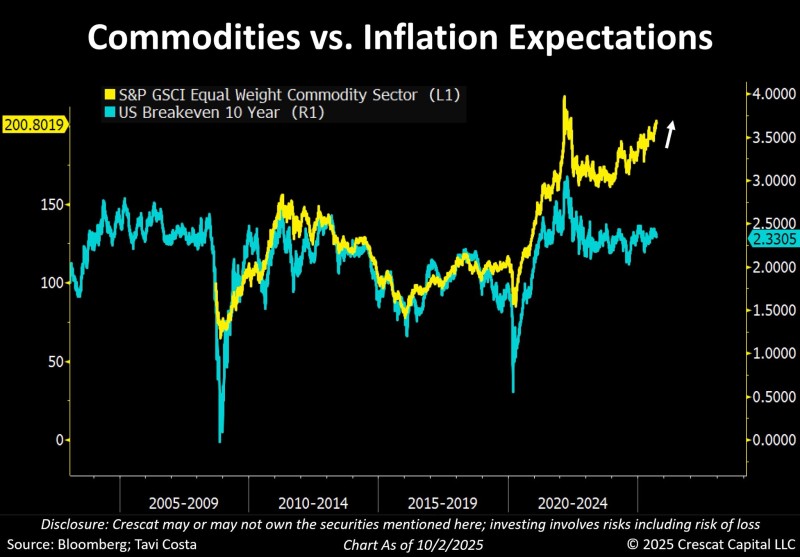

The S&P GSCI Equal Weight Commodity Index and the U.S. 10-Year Breakeven Inflation Rate used to move together. When raw material costs climbed, inflation expectations followed. Today, though, commodities are surging while breakevens hover around 2.3%. Market strategist Otavio (Tavi) Costa points out this represents one of the widest splits we've seen.

He argues that commodity prices give us a more honest read on actual inflation, since virtually every product depends on these raw materials.

Policy Pressures Behind the Disconnect

Financial repression seems to be driving this split. With the Federal Reserve and the Trump administration likely favoring accommodative policies, inflation expectations have been kept artificially low. Meanwhile, commodities keep climbing on strong global demand, supply chain bottlenecks, and geopolitical tensions. Bond markets are betting inflation won't be a problem, but the real economy shows clear stress. Energy costs are up, industrial metals are expensive, and agricultural prices continue rising - all pointing toward pressure that official measures aren't capturing.

What History Tells Us About This Pattern

History shows that commodity surges typically lead inflation expectations higher. Over the past twenty years, whenever commodities rallied like this, inflation expectations eventually caught up. Markets tend to underestimate these pressures until they become impossible to ignore. If inflation expectations snap back to match commodity reality, we're looking at heightened volatility across bonds, stocks, and currencies. For investors, commodities aren't just an interesting play - they're essential insurance against risks that traditional markets are still pricing as negligible.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah