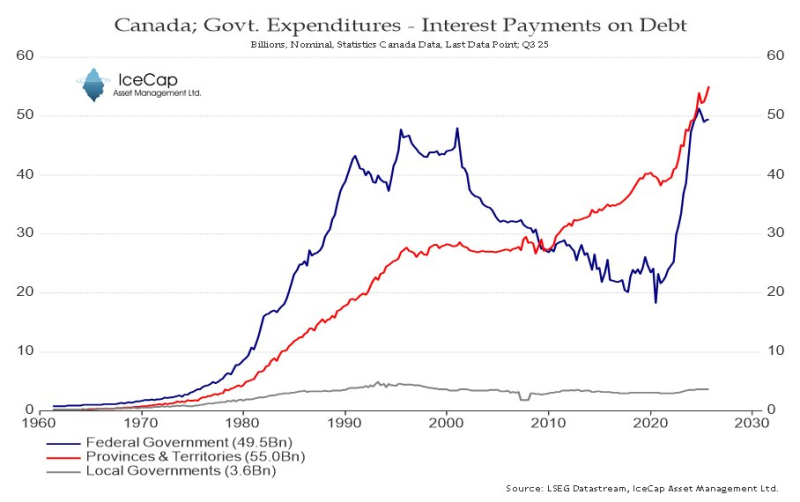

⬤ Canada's debt payments are climbing fast. Federal interest costs are approaching $50 billion while provincial and territorial payments have jumped above $55 billion. Budget deficits and growing debt loads are pushing total interest expenses to levels the country hasn't seen in decades. Local governments add another $3.6 billion to the tab.

⬤ The balance has shifted dramatically. Provinces used to pay less in interest than Ottawa, but now they're carrying the biggest burden nationwide. The provincial line on the chart climbs steadily from the mid-2000s and shoots up sharply after 2020, hitting record highs. The federal line dropped for twenty years but reversed hard recently.

⬤ These numbers matter because rising debt costs squeeze everything else. When interest eats up more revenue, governments have less money for programs just when financial pressure is building. The post-2020 spike exceeds earlier cycles from the 1980s and 1990s, showing how quickly higher rates and bigger deficits are reshaping Canada's fiscal reality. The widening gap between what governments spend and what they can afford increases the chance of major policy changes that could hit the broader economy.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova