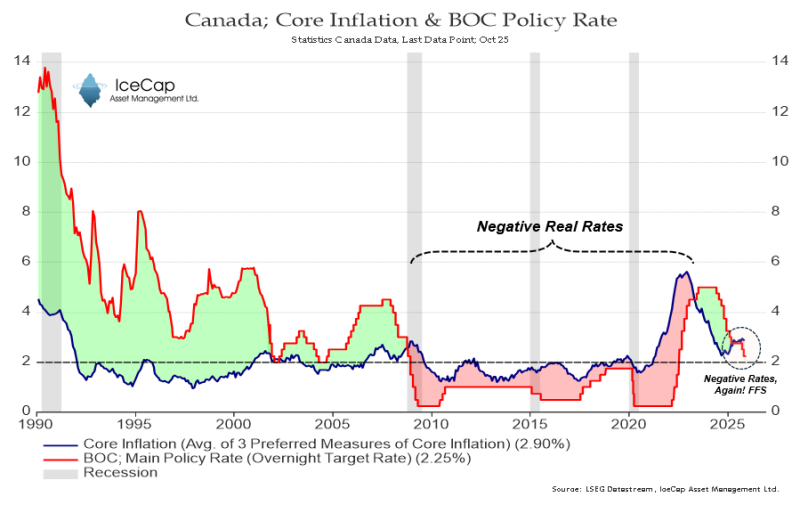

⬤ The Bank of Canada left its Overnight Target Rate unchanged at 2.25%, keeping policy steady even as inflation continues running above that level. This has pushed real interest rates back into negative territory for the first time in recent cycles. A long-term historical chart comparing core inflation with the Bank's policy rate shows multiple periods where real rates dipped below zero, with the current situation near 2025 marking another return to this pattern.

⬤ Recent rate cuts have created conditions where inflation now sits above the benchmark rate, effectively making borrowing costs negative when adjusted for price increases. The concern is that keeping rates below inflation gives governments room to expand spending without tackling the root causes of economic weakness. Historical data shows previous stretches of negative real rates that coincided with periods of economic distortion, and Canada appears to be entering another such phase.

⬤ The bigger worry is that negative real rates don't fix Canada's fundamental problems—sluggish productivity growth, weak business investment, capital leaving the country, heavy regulations, bloated public spending, high taxes, and a housing crisis that won't quit. When policy rates trail inflation for extended periods, it tends to encourage misallocation of capital and widen wealth gaps, particularly in asset markets. The chart's highlighted section showing "Negative Rates, Again" drives home how this cycle is repeating itself.

⬤ Why this matters: sustained negative real interest rates shape where money flows, how stable the economy stays, and what happens to prices over time. If the gap between rates and inflation persists, Canada could face ongoing financial stress, renewed inflation pressure, and worsening structural imbalances right when the economy needs stronger productivity and more private capital investment to move forward.

Peter Smith

Peter Smith

Peter Smith

Peter Smith