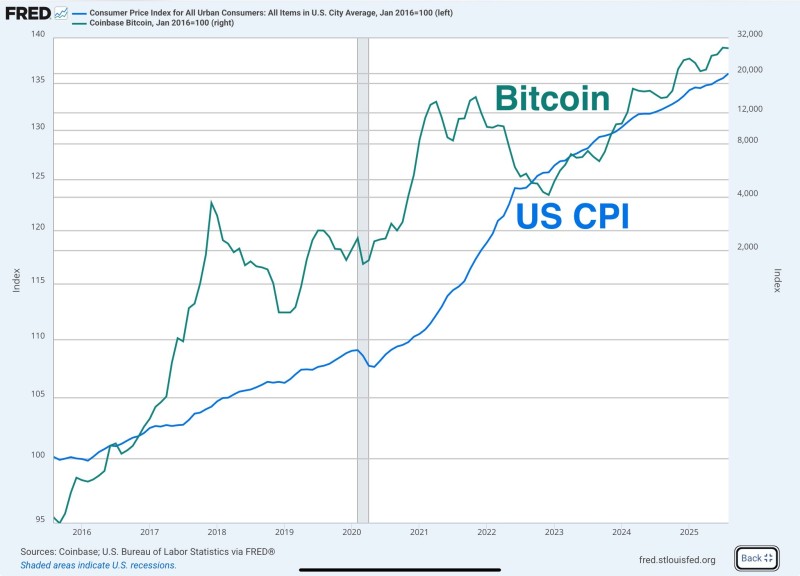

The debate over Bitcoin's role in the global economy often centers on whether it truly acts as a hedge against inflation. When placed alongside the U.S. Consumer Price Index (CPI), the data reveals a compelling narrative. Both Bitcoin and inflation have demonstrated persistent upward momentum since 2016, with the cryptocurrency responding more dramatically to macroeconomic shocks while ultimately tracking the same long-term direction.

Bitcoin and CPI: Long-Term Patterns

Trader James Lavish recently highlighted a chart overlaying Bitcoin's performance (green line) with the U.S. CPI (blue line), and several patterns emerge. From 2016 to 2017, Bitcoin accelerated dramatically while CPI rose modestly, showcasing its higher volatility.

The 2018–2019 period saw Bitcoin correct while inflation continued its steady climb. The 2020–2021 rally marked a turning point - as CPI began accelerating, Bitcoin surged to new highs, reflecting growing investor interest in inflation hedging. Despite inflation peaking in 2022, Bitcoin pulled back sharply, but both metrics resumed their upward trajectory through 2023–2025. This correlation demonstrates that while CPI moves steadily, Bitcoin responds in cycles, often amplifying inflationary trends rather than contradicting them.

What the Chart Reveals

The data underscores three key points. First, inflation appears structural - CPI has climbed over 20% since 2016, reflecting persistent price pressures in the economy. Second, Bitcoin has outpaced CPI significantly. Despite periodic downturns, its long-term growth has far exceeded inflation, strengthening the "digital gold" narrative. Third, investor sentiment plays a crucial role. During inflationary spikes, Bitcoin tends to attract capital as a hedge, though its volatility can distort the short-term picture.

Broader Context

This analysis comes as U.S. inflation, while moderating from 2022 highs, remains above the Federal Reserve's 2% target. Meanwhile, institutional adoption of Bitcoin continues expanding, with ETFs and major asset managers increasingly integrating it into their portfolios. These forces are reinforcing Bitcoin's position in the inflation conversation and its growing acceptance as a legitimate asset class.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah