This regulated forex broker was founded in 2011 and has since grown to become a popular choice for traders around the world.

Some of the key features and benefits of OctaFX

- Regulation: OctaFX is a regulated forex broker that is authorized and licensed by several reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). This ensures that clients can trade with confidence, knowing that their funds are protected and that OctaFX operates in a transparent and fair manner.

- Trading platforms: OctaFX offers a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are available for desktop, web, and mobile devices, and offer a wide range of trading tools and features.

- Account types: OctaFX offers several different account types to suit the needs of different traders, including Micro, Pro, ECN, and Copytrading accounts. Each account type has its own minimum deposit requirement, trading conditions, and features.

- Educational resources: OctaFX provides a range of educational resources for traders, including webinars, trading guides, and video tutorials. This can be helpful for traders who are new to the markets or who want to improve their trading skills.

- Customer support: OctaFX offers customer support 24/7 via live chat, email, and phone. The support team is knowledgeable and responsive and can assist with a wide range of issues and questions.

OctaFX trading platforms

OctaFX offers its clients several different trading platforms to choose from, each with its own unique features and benefits. Here are some of the most popular platforms used in OctaFX:

- MetaTrader 4 (MT4): MT4 is a popular trading platform that is known for its user-friendly interface and powerful charting capabilities. It offers a wide range of technical indicators, as well as the ability to automate trades using expert advisors (EAs). MT4 is available for desktop, web, and mobile devices.

- MetaTrader 5 (MT5): MT5 is the successor to MT4 and offers many of the same features, as well as some additional ones. It has an improved user interface and offers more advanced trading tools, such as depth of market (DOM) and netting and hedging modes. MT5 is available for desktop, web, and mobile devices.

- cTrader: cTrader is a popular trading platform that is known for its advanced charting capabilities and lightning-fast execution speeds. It offers a wide range of technical indicators and also allows for the creation of custom indicators and automated trading strategies. cTrader is available for desktop, web, and mobile devices.

- OctaFX offers a great selection of trading platforms that cater to the needs of traders of all skill levels. Whether you prefer the simplicity of MT4, the advanced features of MT5, or the lightning-fast execution speeds of cTrader, OctaFX has a platform that will suit your needs. Additionally, all of these platforms are available for desktop, web, and mobile devices, so you can trade wherever and whenever you want.

OctaFX regulation

OctaFX is a regulated online forex and CFD broker that is licensed and authorized by several reputable regulatory bodies. This ensures that OctaFX operates in a transparent, fair, and secure manner, and that client funds are protected.

Here are the regulatory bodies that oversee OctaFX:

- Financial Conduct Authority (FCA): OctaFX is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. The FCA is one of the most respected financial regulatory bodies in the world and is known for its strict regulatory standards.

- Cyprus Securities and Exchange Commission (CySEC): OctaFX is also regulated by the Cyprus Securities and Exchange Commission (CySEC). CySEC is a well-respected regulatory body that oversees financial institutions in Cyprus, which is a popular location for forex brokers.

- Saint Vincent and the Grenadines Financial Services Authority (SVGFSA): OctaFX is registered and authorized by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). While the SVGFSA is not as well-known as some other regulatory bodies, it still provides a level of oversight and protection for clients of OctaFX.

- Overall, OctaFX is a well-regulated broker that is authorized and licensed by several reputable regulatory bodies. This ensures that clients can trade with confidence, knowing that their funds are protected and that OctaFX operates in a transparent and fair manner.

Octafx minimal deposit

The minimum deposit for OctaFX varies depending on the account type you choose. OctaFX offers several different account types to suit the needs of different traders, each with its own minimum deposit requirement.

Here are the minimum deposit requirements for OctaFX's different account types:

- Micro account: The minimum deposit for a Micro account is $5.

- Pro account: The minimum deposit for a Pro account is $500.

- ECN account: The minimum deposit for an ECN account is $50.

- OctaFX Copytrading account: The minimum deposit for an OctaFX Copytrading account is $100.

It's worth noting that these minimum deposit requirements are subject to change, and may vary depending on the currency you're depositing and the payment method you're using. Additionally, while these minimum deposit requirements are relatively low, it's always a good idea to deposit an amount that you're comfortable with and that allows you to meet your trading goals.

OctaFX money safety

OctaFX takes the safety and security of client funds very seriously, and has implemented several measures to ensure that client funds are protected at all times.

Here are some of the ways that OctaFX ensures money safety for its clients:

- Regulation: As mentioned earlier, OctaFX is authorized and licensed by several reputable regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). These regulatory bodies require OctaFX to adhere to strict guidelines and standards, which helps to ensure that client funds are protected.

- Segregated accounts: OctaFX keeps client funds in segregated accounts, which means that client funds are kept separate from the broker's own funds. This helps to ensure that client funds are not used for any purposes other than trading, and provides an additional layer of protection for client funds.

- Negative balance protection: OctaFX provides negative balance protection, which means that clients cannot lose more than their account balance. This helps to protect clients from large losses in volatile market conditions.

- Secure payment methods: OctaFX offers a range of secure payment methods, including bank transfers, credit/debit cards, and e-wallets. These payment methods use advanced encryption and security measures to protect client information and funds.

- Regular audits: OctaFX undergoes regular audits by independent third-party auditors to ensure that it is operating in a transparent and fair manner, and that client funds are protected.

Overall, OctaFX takes money safety very seriously and has implemented several measures to ensure that client funds are protected at all times. From regulation and segregated accounts to negative balance protection and secure payment methods, OctaFX provides a safe and secure trading environment for its clients.

Is it OctaFX legal or scam

Yes, OctaFX is a legal and regulated broker that is authorized and licensed by several reputable regulatory bodies.

OctaFX is authorized and regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). These regulatory bodies require OctaFX to adhere to strict guidelines and standards, which ensures that the broker operates in a transparent, fair, and secure manner, and that client funds are protected.

It's important to note that the regulatory requirements and standards may vary depending on the jurisdiction in which you reside. Therefore, it's always a good idea to check with your local regulatory body to ensure that OctaFX is authorized to operate in your country or region.

Overall, OctaFX is a legal and regulated broker that provides a safe and secure trading environment for its clients.

The list of countries where OctaFX works

OctaFX is a global online forex and CFD broker that provides services to clients in many countries around the world. According to their website, they offer services to clients in over 100 countries, including the United Kingdom, the European Union, South Africa, India, Indonesia, Malaysia, and many more. However, it's important to note that the availability of their services may vary depending on the regulations and laws of each country.

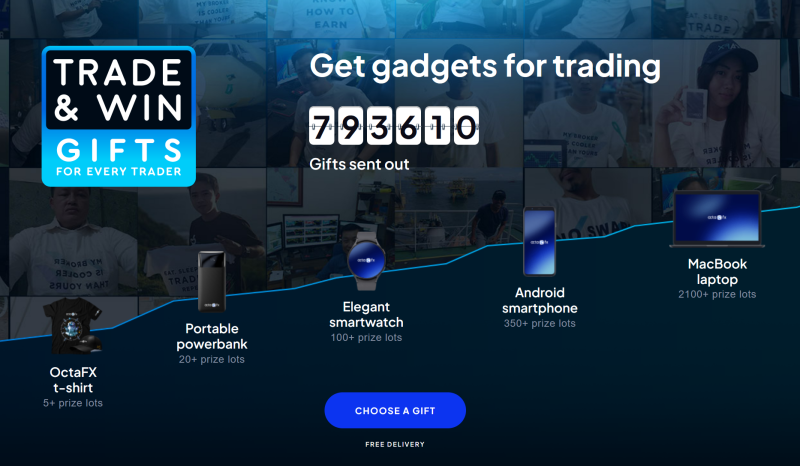

OctaFX contests

OctaFX regularly organizes trading contests for its clients, including demo trading contests. These contests are designed to provide traders with an opportunity to test their trading skills and strategies in a risk-free environment, while also competing for prizes.

The OctaFX trading demo contest is a popular contest that is open to all clients who have a demo account with the broker. The contest runs for a specified period of time, usually a month, and participants are required to trade with virtual funds in a demo account.

During the contest period, participants are ranked based on their trading performance, including factors such as profit, drawdown, and the number of trades made. The top-performing traders at the end of the contest period are awarded prizes, which may include cash prizes, trading bonuses, or other rewards.

Participating in the OctaFX trading demo contest is a great way for traders to improve their skills and test their strategies in a competitive environment, without risking any real money. It's also an opportunity to win prizes and gain recognition for your trading abilities.

If you're interested in participating in the OctaFX trading demo contest, you can visit their website to learn more about the rules and requirements, as well as the current and upcoming contests.

OctaFX bonus programs

Sure, here is a list of some of the bonuses that are currently available at OctaFX:

- Deposit bonus: OctaFX offers a deposit bonus for clients who make a deposit into their trading account. The bonus amount varies depending on the deposit amount and the type of account and may be used for trading purposes.

- Tradable bonus: This bonus is designed to increase the trading volume of clients and is available for both new and existing clients. The bonus can be used for trading purposes and can be withdrawn after meeting certain trading volume requirements.

- Champion demo contest: OctaFX regularly organizes demo trading contests for its clients, with cash prizes awarded to the winners. These contests are a great way to test trading strategies and improve trading skills.

- Supercharged 2 real contest: This is a live trading contest that offers cash prizes to top-performing traders. The contest runs for a specified period of time and participants are ranked based on their trading performance.

- Rebate program: OctaFX offers a rebate program that provides clients with cash rebates for every trade they make, regardless of whether the trade is profitable or not.

- It's important to note that bonuses and promotions may vary depending on the regulations and laws of each country, and may be subject to terms and conditions. Clients should carefully review the terms and conditions of any bonus or promotion before participating.

Conclusion

Overall, OctaFX is a well-regulated broker that offers a range of trading instruments, platforms, and account types. The broker is suitable for traders of all skill levels, and provides a range of educational resources and customer support options.

Editorial staff

Editorial staff

Editorial staff

Editorial staff