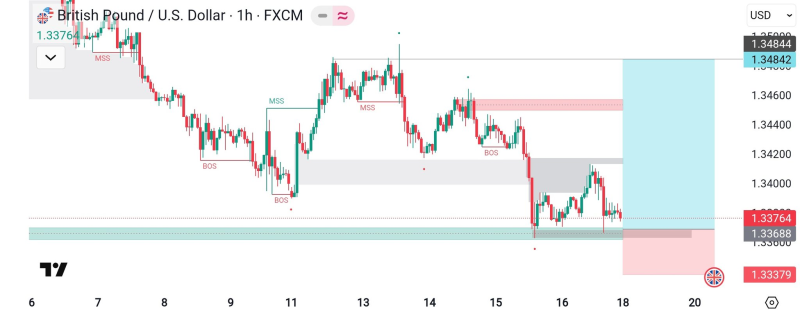

⬤ GBP/USD bounced sharply after dropping into a well-defined hourly demand zone near 1.3360–1.3370, where buyers stepped in quickly. The pair recovered from this level following a broader pullback, with the chart showing long rejection wicks and fading downside momentum. Sellers couldn't push through the demand area, leading to short-term stabilization above support.

⬤ The chart shows the demand zone acting as a technical floor that triggered a bounce and narrow consolidation. Multiple candles display lower-wick rejections, showing buyers absorbed downside attempts. After the initial rebound, GBP/USD settled into a tight range just above support as traders reassessed direction.

⬤ Structurally, the bounce followed earlier breaks on the hourly timeframe that increased volatility before price returned to support. Key reference levels sit above the current range—around 1.3515, 1.3650, and 1.3880—aligning with prior swing highs and resistance zones. On the downside, a sustained break below 1.3335 would undermine the current defense and signal renewed selling pressure.

⬤ This price action matters because GBP/USD often reflects shifts in short-term dollar sentiment and broader positioning. Holding the 1.3360 area could support further upside attempts, while losing this zone would shift focus back to downside continuation. With price consolidating at a clear inflection point, the next sessions will likely determine whether the pair builds a deeper recovery or stays range-bound near support.

Peter Smith

Peter Smith

Peter Smith

Peter Smith