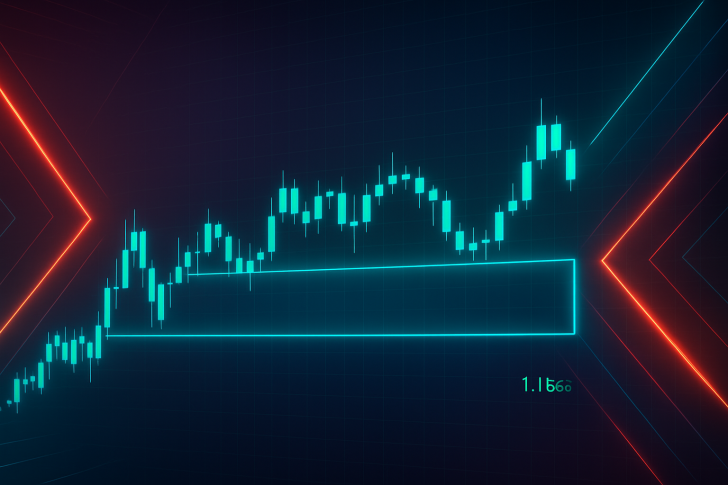

⬤ EUR/USD has been trading in a tight range between 1.1530 and 1.1560 on the hourly chart, unable to pick a clear direction. This zone lines up with the point of control at 1.1527—a critical area where the price is having trouble building momentum. The overall trend leans bearish, and the recent bounce got turned away right at the 0.618 Fibonacci level near 1.1538.

⬤ The chart shows a descending trendline still acting as a ceiling, keeping EUR/USD pressured during the session. Technical indicators aren't giving much away: RSI is sitting around 53, showing no real push either way, while Bollinger Bands are tightening—usually a sign that a bigger move is coming soon. Volume has been light during this consolidation, pointing to indecision across the board. Delta readings hint at slightly more buying interest in recent candles, but not nearly enough to shift the momentum. Parabolic SAR is flashing a long signal, though that's hard to trust given the sideways action.

⬤ Key levels are shaping the near-term outlook. Support is found at 1.1512, 1.1505, and 1.1491, while resistance sits at 1.1538, 1.1550, and 1.1568. The rejection from 1.1538 shows just how solid that resistance zone is. Price is hovering right around the 1.1527 POC level, reinforcing the idea that we're stuck in the middle of the recent value area. The market seems to be waiting for a spark before committing to a breakout.

⬤ The bigger picture isn't helping EUR/USD much. A strong U.S. dollar and persistent rate expectations are weighing on the pair, while weak Eurozone economic data continues to cap upside potential. For bulls to take control, we'd likely need to see the dollar index lose steam—that could give EUR/USD the breathing room it needs to challenge resistance and finally break out of this tight range.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets