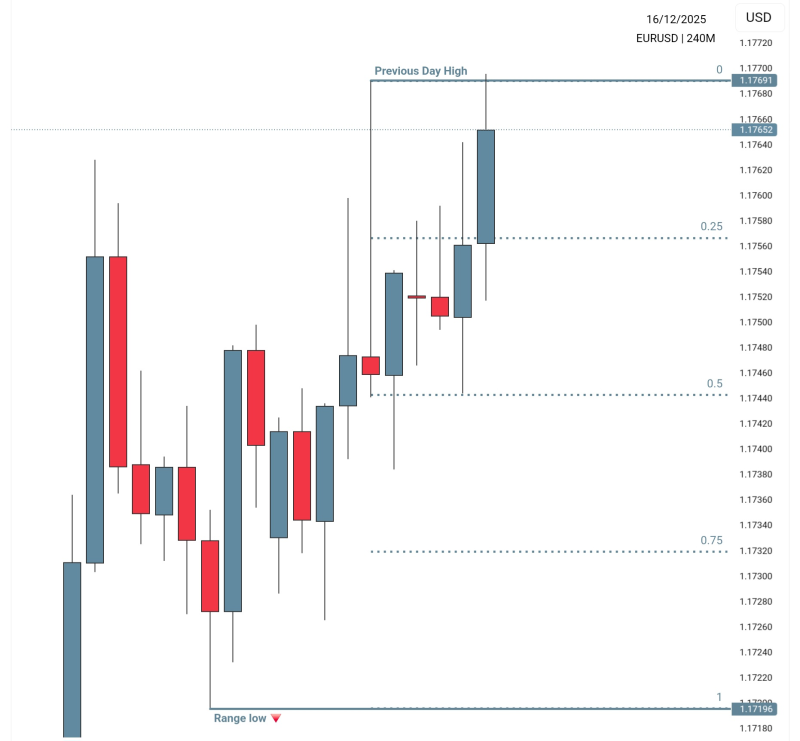

⬤ EUR/USD rose in a straight line on the four hour chart travelling from about 1.1720 to yesterday's peak near 1.1769. After touching the bottom of its range the pair entered the area that traders label the premium zone - the upper slice of the present band where price normally meets selling interest.

⬤ The chart displays a tidy intraday pattern - yesterday's top forms the lid and the range low forms the base. While EUR/USD crossed the middle ground it paused at the 0.25, 0.50 and 0.75 markers climbing in measured steps from floor to ceiling. Bullish bars are still present - yet the rate now sits where sellers have entered before.

This backdrop points to possible short trades during the New York killzone, the window when liquidity normally swells.

⬤ The vital point is that price has not yet closed above yesterday's high - it is only probing it. The action therefore remains range bound rather than break out. The New York session carries weight because volume rises there plus those levels tend to provoke genuine responses.

⬤ The pattern is significant because it illustrates how the clock and the range shape short term moves in forex. When EUR/USD reaches the premium band without punching through, momentum usually fades and price grows sensitive to the day's order flow. Yesterday's high keeps its role as the main reference without hinting at any larger trend change.

Peter Smith

Peter Smith

Peter Smith

Peter Smith