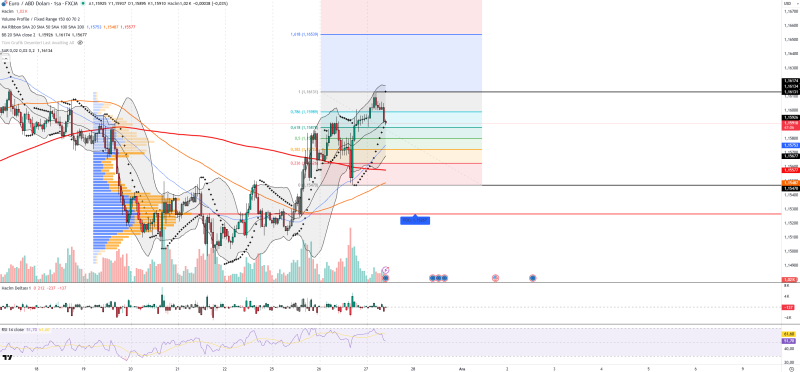

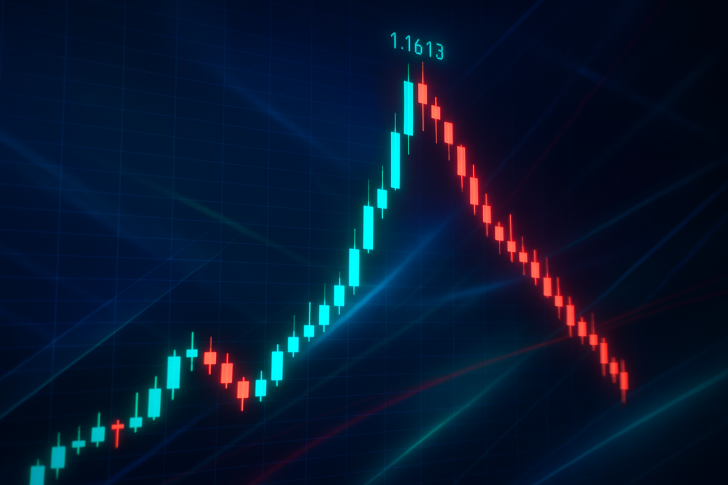

⬤ EUR/USD's turned lower after getting rejected at the 1.1613 resistance level, putting a pause on the sharp recovery we saw earlier. The latest pullback looks more like cooling momentum than a full trend reversal—the pair's still trading inside a short-term rising structure. The chart shows EUR/USD slipping below the upper Bollinger Band and easing toward Fibonacci retracement levels after that initial surge.

⬤ The short-term setup shows buyer strength fading, with recent candles catching some reaction selling after testing resistance. EUR/USD is currently hovering around the 0.618 and 0.5 Fibonacci zones from the recent swing. The RSI reading near 52 points to a neutral stance, matching up with the moderation in upward pressure. The Parabolic SAR has flipped above price, signaling a shift toward short-term downside bias. Volume analysis backs this up—the Volume Delta's negative and the pair's dipped below the middle Bollinger Band, opening room to the downside without triggering heavy selling. Key supports sit at 1.1587, 1.1575, and 1.1558, while 1.1599 and 1.1613 act as the nearest resistance barriers.

⬤ Another technical detail worth noting is the 1.1527 Point of Control, which represents the dominant volume zone of the recent range. This area stands out as a central balance point and could act as a magnet if EUR/USD extends its corrective move. The broader moving average structure, including the 200-period line, remains positioned below price—showing the larger trend hasn't broken yet. However, the loss of immediate momentum following the 1.1613 rejection lines up with the short-term cooling phase visible on the chart.

⬤ This movement in EUR/USD matters given what's happening in the broader market. The dollar index continues showing strength while the European side lacks a strong positive catalyst. Combined with shifting global risk appetite and the ECB's liquidity-related remarks, these factors keep weighing on euro sentiment. With markets focused on upcoming US macro data and Federal Reserve signals, EUR/USD might stay sensitive to short-term corrections while the broader trend dynamics continue playing out.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah