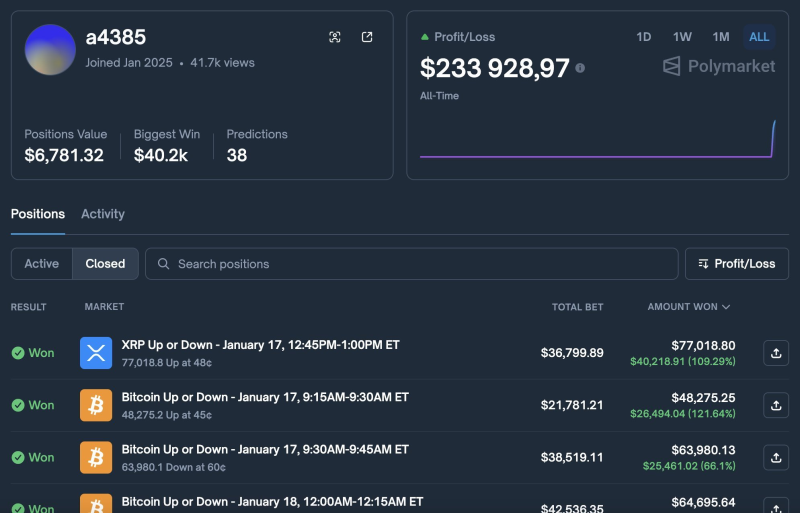

⬤ A Polymarket trader going by "a4385" made approximately $233,000 in just one day by spotting and capitalizing on a temporary liquidity gap in XRP markets. The strategy revolved around a 15-minute Polymarket contract tied to XRP's price movement on January 17—a time when weekend trading activity was unusually quiet on both prediction platforms and spot exchanges.

⬤ Market data shows the trader systematically bought every available "up" contract on Polymarket while liquidity stayed shallow. Automated market makers kept selling into the rising prices rather than pulling back, completely missing the growing imbalance. XRP actually dipped about 0.3% during the contract window, but persistent buying pressure drove the implied payout price of those "up" contracts higher and higher. By the final minutes, the trader had stacked up around 77,000 contracts at an average entry of roughly $0.48 each.

The strategy centered on a 15-minute contract during unusually low weekend trading activity, highlighting how precise timing turned thin markets into opportunity.

⬤ The winning move came right before settlement. About two minutes before the Polymarket contract closed, a different wallet dropped an estimated $1 million spot buy on Binance, pushing XRP up approximately 0.5% and locking in the favorable contract outcome. The spot position got unwound immediately after. Total execution costs—fees and slippage combined—ran around $6,200, leaving the overall play solidly profitable.

⬤ The trader apparently ran this same playbook multiple times throughout the night across different 15-minute markets, including similar Bitcoin contracts. The whole episode shows how shallow liquidity, ultra-short contracts, and automated trading can temporarily mess with pricing. For XRP specifically, it's a reminder that off-peak hours can create brief market inefficiencies affecting short-term price action and overall stability.

Usman Salis

Usman Salis

Usman Salis

Usman Salis