XRP (Ripple) price dynamics are getting a reality check from crypto experts who say the pre-mined vs mined debate is basically pointless for long-term investors.

Bitcoin maximalist Robert Breedlove recently said "XRP is 100% pre-mined. BTC is 0%" on social media, treating this like a major red flag. But the XRP community has solid counter-arguments that are hard to ignore.

Why XRP and Bitcoin Are More Similar Than You Think

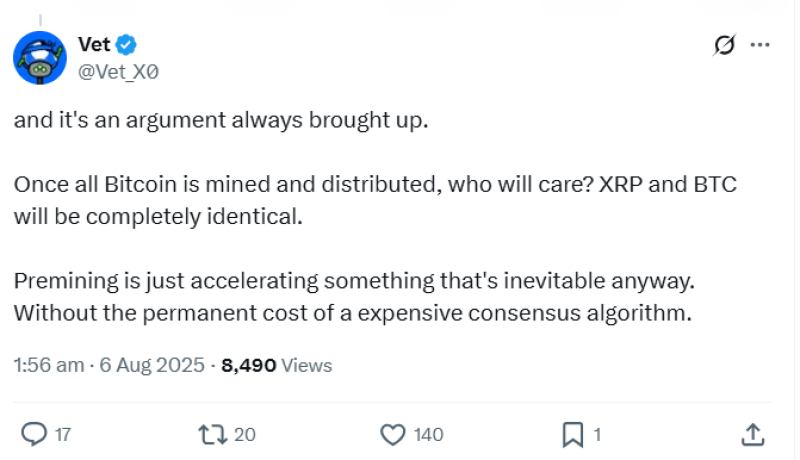

Vet, who runs XRPCafe and validates XRP Ledger transactions, makes a compelling point: once Bitcoin finishes mining all 21 million coins, it'll be economically identical to XRP. How coins get distributed initially becomes less important over time when both assets have fixed, trackable supplies.

Legal analyst Bill Morgan agrees, saying the mined vs pre-mined debate is more ideology than practicality. What matters is supply caps and transparent distribution – both XRP (100 billion max) and Bitcoin (21 million cap) have these covered.

XRP (Ripple) Price vs Bitcoin: Numbers Tell the Real Story

Bitcoin's trading around $114,000 with 19.9 million coins circulating. XRP sits near $3 with over 59 billion tokens in the market. Both networks handle massive daily volumes, proving real demand exists.

As Vet puts it, pre-mining just "accelerates something that's inevitable anyway" minus Bitcoin's energy costs. While crypto Twitter argues ideology, markets care more about where coins are headed than their origin stories.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah