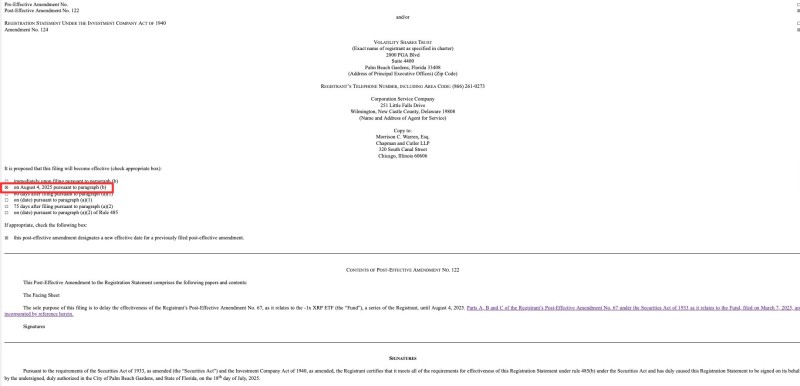

The timeline for the launch of the first inverse XRP ETF has shifted. According to Post-Effective Amendment No. 122 filed under the Investment Company Act of 1940, Volatility Shares Trust has officially postponed the effective date for its -1x XRP ETF to August 4, 2025, under Rule 485(b).

The amendment delays the effectiveness of Post-Effective Amendment No. 67, originally filed on March 7, 2025, and relates specifically to the -1x XRP ETF—a fund designed to deliver inverse daily performance of XRP.

Inverse XRP ETF Launch Moved to August — Strategic Delay or Regulatory Buffer?

The filing confirms that the effective date of the inverse XRP ETF is now scheduled for August 4, 2025. While no reason is explicitly stated in the amendment, such delays are often interpreted as part of internal regulatory timelines or issuer adjustments ahead of launch.

The ETF, issued by Volatility Shares Trust, reflects growing interest in leveraged and inverse crypto products. Once active, the fund would offer institutional and retail investors a new tool for short-term directional exposure to XRP price movements.

XRP Price Prediction: Will the ETF Delay Impact Short-Term Sentiment?

Although the ETF’s function is bearish by nature, its existence signifies expanding demand for XRP-linked financial instruments within traditional markets. Some analysts suggest that the delay may temporarily reduce short-term pressure, while others argue it offers time for market recalibration ahead of a new wave of ETF-related volatility.

With XRP (XRP) trading actively ahead of broader ETF developments, the August 4 date now becomes a focal point. Whether the delay leads to a cooling-off period or builds momentum for launch day remains to be seen—but the market is watching.

Usman Salis

Usman Salis

Usman Salis

Usman Salis