XRP has crashed 13.6% since late July, breaking below the key $3 level while Bitcoin fell just 5%. Technical indicators are flashing red, but one crucial support zone could change everything.

XRP is having a rough time lately. While Bitcoin dropped 5% from its $119.8k high since Monday, July 28th, XRP got hit way harder with a brutal 13.6% decline. The real kicker? It smashed through the $3 psychological barrier that had been holding strong earlier in July.

This isn't just about numbers - losing $3 is a big deal for XRP. That level used to be where bulls made their stand, but now it's turned into a wall of resistance. Getting back above $3 won't be easy with all the selling pressure and profit-taking happening up there.

XRP Price Technicals Paint a Grim Picture

Looking at the 12-hour chart, things don't look great for XRP bulls right now. The Accumulation/Distribution line is trending down hard, showing that sellers are clearly in control over the past week. The Awesome Oscillator is also flashing bearish signals - not what you want to see if you're holding XRP.

But here's the real nail in the coffin: the Directional Movement Index tells the whole story. Both the -DI and ADX are sitting above 20, which basically screams "strong downtrend in progress." With all these indicators pointing south, XRP could easily drop more before buyers get brave enough to jump back in.

However, there's one level worth watching - $2.6. This spot lines up with a Fair Value Gap and matches old resistance levels on the daily chart, making it a likely place where XRP might finally catch its breath.

XRP Price Could Find Support at $2.6

The $2.6 level isn't just random - it's where several technical factors come together. There's a Fair Value Gap there (basically a spot where price moved too fast and left a hole), plus it matches up with previous highs that could now act as support.

If XRP does slide down to $2.6, it might actually be a decent buying opportunity for anyone thinking long-term. Sometimes the best entries come when everything looks terrible.

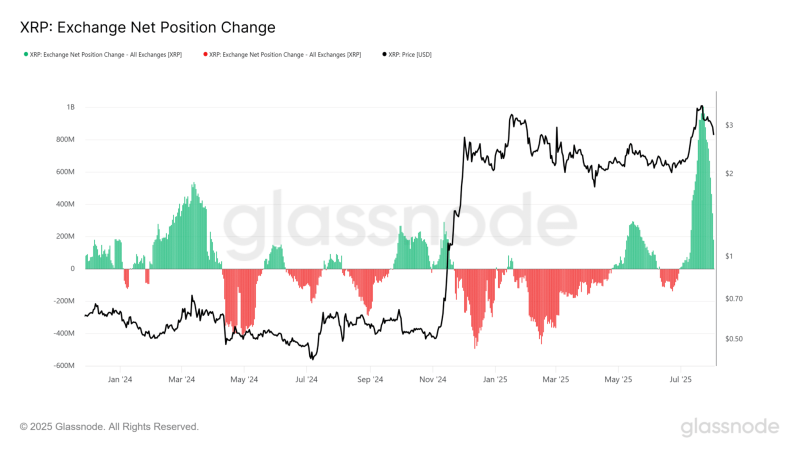

Exchange data shows XRP holders were dumping tokens like crazy, with inflows peaking on July 23rd. When over 90% of holders are sitting on profits (which they were), selling becomes pretty tempting. But here's the thing - that massive selling seems to be cooling off now.

The MVRV Z-Score suggests XRP isn't wildly overvalued despite that July rally above $3. This means there could still be room for growth once this selling wave passes. For patient investors, any dip toward $2.6 might be worth considering - if you can handle the volatility.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah