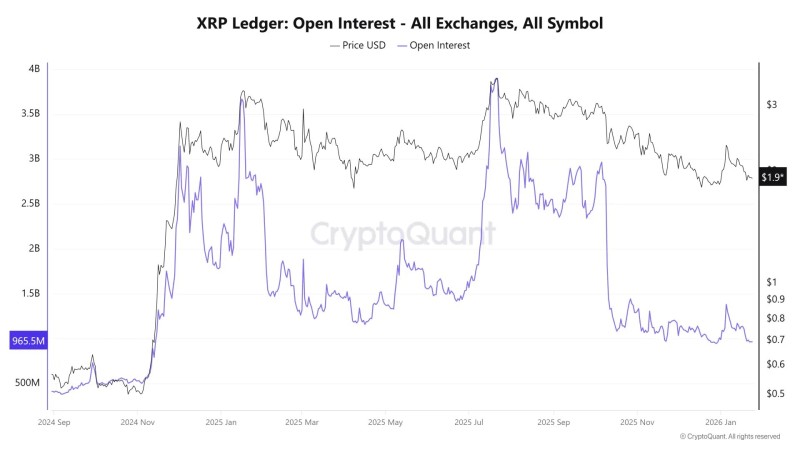

⬤ XRP open interest has hit a 14-month low at roughly $965 million across major exchanges. That's a massive drop from the $3 billion+ levels we saw earlier in the cycle, yet the price is still hanging around $1.90. Fewer traders are putting money on the table with leverage, which means the derivatives market has basically gone quiet.

⬤ Looking at the data, every time XRP's price spiked in late 2024 and mid-2025, open interest surged right alongside it. Traders were piling in with leverage during those runs. But now? Open interest keeps sliding while price action stays flat. People aren't betting big anymore—they're pulling back or sitting on the sidelines.

⬤ When open interest drops like this over months rather than crashing overnight, it's usually not panic—it's withdrawal. Traders are closing positions gradually, not getting liquidated in waves. That means the market might actually be less volatile in the short term since there aren't as many leveraged bets that could get wiped out and trigger cascading sells.

⬤ Open interest is one of the best ways to measure how much speculative heat is in the market. Right now, there's not much. Low open interest usually means consolidation—traders waiting for a clearer signal before jumping back in. If leverage starts building again, we could see bigger moves. But for now, the XRP derivatives scene is pretty cold.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov