Ripple President Monica Long just dropped some serious optimism at the XRPL Apex event, calling this the "real turning point" for crypto thanks to regulatory clarity finally happening. Meanwhile, XRP Ledger quietly launched tokenized U.S. Treasuries and commercial paper – the kind of Wall Street stuff that could change everything.

XRP Getting Some Love as Ripple President Says Things Have "Never Been Better"

So Monica Long, Ripple's President, just gave this keynote at the XRPL Apex event in Singapore, and she was basically saying what a lot of us have been thinking – we might finally be at that moment where crypto stops being the wild west and starts becoming, you know, actual financial infrastructure.

Her big point? Regulatory clarity is finally here, and it's a total game-changer. For years, Ripple and basically every other crypto company has been dealing with potential partners who were like "Yeah, this looks cool, but what if the government decides to shut it down tomorrow?" It's been absolutely brutal trying to build anything serious when nobody knows what the rules are.

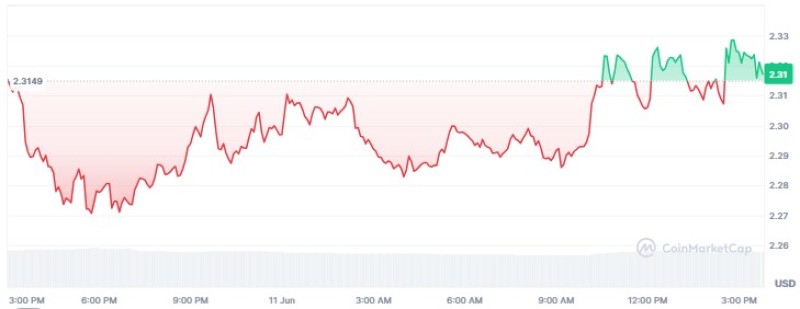

But Long's take is that we're past all that now. "It's taken time to get to where we are in this moment, but it has never been better," she said. And honestly, when you look at what's happening with XRP right now, she might not be wrong.

RippleX posted about it on X, saying: "Regulatory clarity. Ripple President Monica Long closes out Day 1 on the Apex main stage by sharing how clear rules in the U.S. can unlock massive opportunities for global crypto innovation and why momentum is finally shifting."

That's not just marketing speak – there's actual stuff happening that backs up what she's saying.

XRP Ledger Just Got Some Serious Wall Street Cred

Here's where things get really spicy for XRP. While everyone's talking about regulatory clarity, the XRP Ledger just quietly pulled off something pretty huge – tokenized U.S. Treasuries are now live on the network.

We're talking about Ondo Finance's OUSG, and here's the kicker – it's backed by BlackRock's BUIDL fund. BlackRock! That's not some random DeFi project, that's literally the biggest asset manager in the world deciding XRP Ledger is good enough for their stuff. You can mint and redeem these using Ripple USD (RLUSD), and it gives you 24/7 access to Treasury products.

RippleX is calling this "a new era for on-chain finance," and they're not being dramatic. When BlackRock starts using your blockchain for real financial products, that's when you know you've made it.

But wait, it gets better. Digital Commercial Paper (DCP) is also now running on XRP Ledger, managed by Guggenheim Treasury Services. These guys are described as "one of the world's leading independent commercial paper platform administrators," which is fancy talk for "really important Wall Street people." And they chose XRP Ledger to run their stuff.

This isn't just about XRP price going up (though that's nice too). This is about the entire ecosystem becoming the backbone for actual financial infrastructure that big institutions want to use.

XRP Positioned Perfectly as America Goes Pro-Crypto

The timing of all this is honestly perfect. At another session during XRPL Apex 2025, Brad Garlinghouse, Monica Long, and Pat Patel were talking about the momentum they're seeing, and one quote really jumped out: "I think people grossly underestimate how much momentum will be created by the largest economy in the world finally shifting into a pro-innovation and pro-crypto posture."

That's not wishful thinking – that's based on what they're actually seeing happen. The U.S. is getting more crypto-friendly, Asia's been building like crazy, and institutions are finally diving into blockchain for real stuff like stablecoins and real-world assets (RWAs).

What's really smart about XRP's position is that while other crypto projects are still trying to figure out how to deal with regulators, Ripple's been fighting that battle for years. All those legal headaches and compliance work? That's actually turning into a massive advantage now that everyone else has to deal with the same stuff.

Plus, having actual products like tokenized Treasuries and commercial paper running on your network isn't just cool tech – it's proof that your blockchain can handle serious financial business. When traditional finance companies start building on your platform instead of just talking about it, that's when you know something real is happening.

Look, Monica Long might be biased since it's her company, but when you've got BlackRock and Guggenheim running products on XRP Ledger while the regulatory environment is getting friendlier, it's hard to argue that this isn't a pretty sweet spot to be in. If this really is the "turning point" she's talking about, XRP seems like it's positioned to make the most of it.

Usman Salis

Usman Salis

Usman Salis

Usman Salis