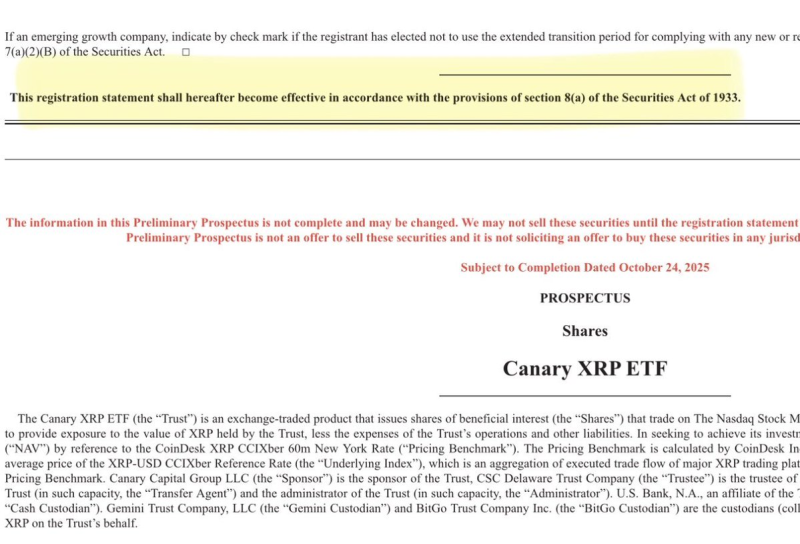

● In a significant move for crypto regulation, the Canary XRP ETF is now set for auto-effective approval on November 13 after removing the SEC delay clause from its registration. The updated SEC filing states it will "become effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933" — meaning it goes live automatically unless the SEC intervenes.

● The proposal creates an XRP Spot ETF that lets investors get direct XRP price exposure through Nasdaq-traded shares. Canary Capital Group LLC sponsors the fund, with Gemini Trust Company, BitGo Trust Company, and U.S. Bank N.A. handling custody and administration. The fund's value will track the CoinDesk XRP CCIXber 60m New York Rate for transparent pricing.

● The main risk? The SEC could still step in before November 13. While removing the delay clause shows confidence from Canary, the commission can pause or review the filing if compliance or market concerns pop up. But if the SEC stays quiet, this becomes the first U.S. XRP Spot ETF.

● For markets, XRP ETF approval could drive major liquidity and institutional interest. Analysts expect inflows similar to early Bitcoin Spot ETF surges — potentially billions flowing into XRP and boosting confidence across crypto.

Peter Smith

Peter Smith

Peter Smith

Peter Smith