Wall Street has spoken. For the first time, S&P has released an institutional-grade cryptocurrency index that ranks digital assets by market weight—and XRP has claimed the number three position. This placement represents a significant shift in how traditional finance views utility-focused cryptocurrencies, moving beyond the Bitcoin-Ethereum duopoly that has dominated institutional narratives.

Official Rankings

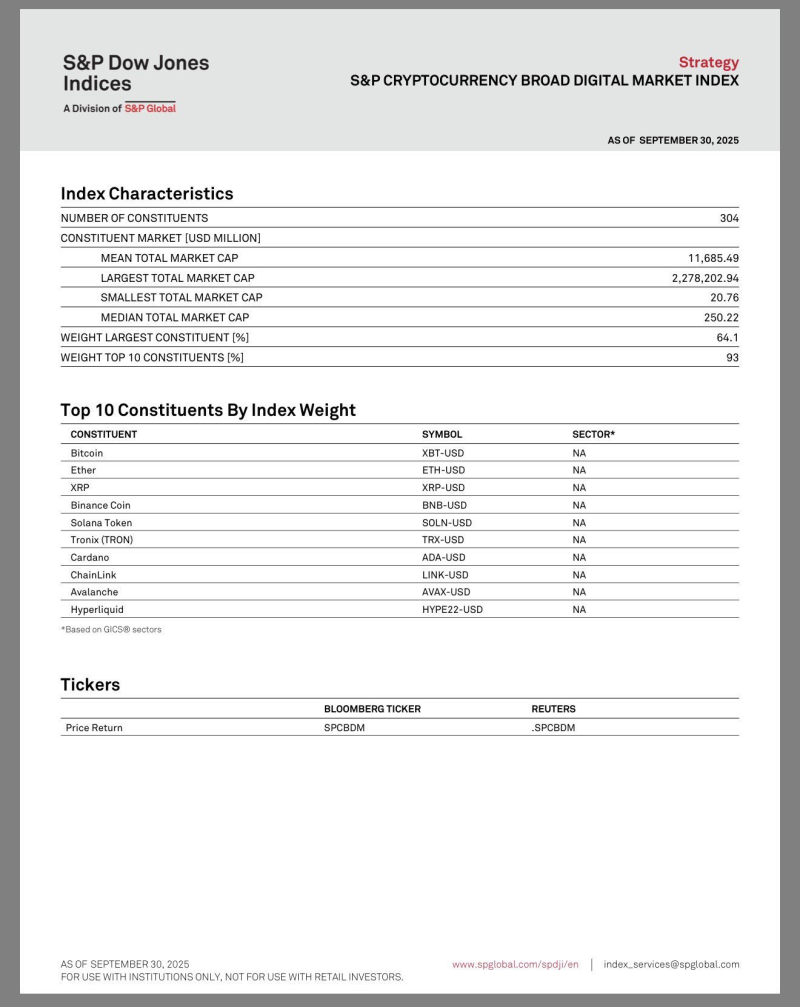

According to the S&P Cryptocurrency Broad Digital Market Index data from September 30, 2025, Bitcoin maintains its leading position with 64.1% of the index weight, followed by Ethereum in second place, and XRP securing third. This ranking places XRP ahead of established competitors including Binance Coin, Solana, Cardano, and Avalanche. The index itself tracks 304 cryptocurrencies with a mean market cap of $11.6 billion, though the top 10 assets account for 93% of total weight.

As highlighted by crypto analyst John Squire, this recognition puts XRP in direct comparison with the two largest cryptocurrencies by market capitalization—a validation that extends beyond mere numbers to signal institutional acceptance of payment-focused digital assets.

Market Impact

The implications are straightforward but meaningful. Investment funds and ETFs designed to track S&P crypto indices will now allocate capital to XRP proportionally, bringing institutional money flow that previously remained on the sidelines. XRP's established role in cross-border payments and financial infrastructure now carries the weight of a Wall Street benchmark, lending credibility to its utility case. The token's positioning above numerous competitors reinforces its staying power in an increasingly consolidated market where the top assets capture the vast majority of attention and capital.

This development reflects a broader trend: digital assets are moving from speculative fringe to recognized asset class. For XRP specifically, sharing the podium with Bitcoin and Ethereum isn't just symbolic—it's a signal that may influence allocation decisions across institutional portfolios in the months ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis