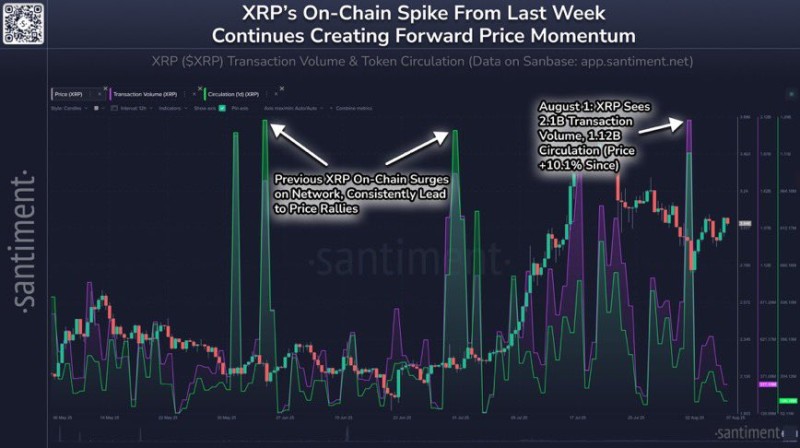

XRP is catching fire again, and the numbers tell a compelling story. Fresh on-chain data shows network activity just hit its highest point in six months, and the price is responding exactly how you'd expect. We're talking about a solid 10.1% pump that's got traders wondering if this is just the beginning.

The timing couldn't be more interesting. On August 1st, XRP's network processed 2.1 billion in transaction volume while 1.12 billion tokens changed hands – numbers that immediately caught the attention of seasoned crypto watchers. Since then, XRP has steadily climbed from around $2.95 to its current $3.25, and the momentum doesn't seem to be slowing down.

XRP Price Action Follows Historical Pattern

Here's where things get really interesting. Previous spikes in these exact metrics have consistently led to significant price rallies for XRP. It's like watching the same movie play out again – network utility spikes, price follows, and traders who caught it early celebrate.

The beauty of on-chain analysis is that it cuts through the noise. While Twitter debates and market sentiment can be misleading, actual network usage tells the real story. When 2.1 billion worth of transactions flow through XRP's network in a single day, that's not speculation – that's real demand.

What makes this rally particularly noteworthy is its organic nature. We're not seeing whale manipulation or coordinated pump attempts. Instead, the data suggests genuine increased adoption and utility, which historically provides a much stronger foundation for sustained price growth.

XRP Network Utility Drives Real Demand

The surge in both transaction volume and token circulation points to something crypto investors love to see: actual use cases driving demand. Whether it's cross-border payments, institutional adoption, or increased trading activity, the network is clearly being put to work.

This isn't just about speculation anymore. When transaction volumes hit six-month highs, it suggests that XRP is fulfilling its intended purpose as a bridge currency for international payments. That's the kind of fundamental strength that can support long-term price appreciation, not just short-term pumps.

The correlation between network activity and price performance has been remarkably consistent for XRP throughout its history. Smart money tends to follow these patterns, and right now, all signs point to continued strength if the on-chain metrics hold up.

What's Next for XRP Price?

With momentum clearly on XRP's side, the question isn't whether the rally will continue – it's how far it can go. The current resistance levels around $3.30-$3.35 will be crucial to watch. A clean break above these levels could open the door to much higher targets.

The broader crypto market conditions are also playing in XRP's favor right now. Unlike previous rallies that happened during bear markets, this surge is occurring while overall sentiment remains relatively positive. That's typically a recipe for sustained moves rather than quick reversals.

Of course, crypto markets can shift on a dime, and any significant drop in network activity could cool things down quickly. But for now, XRP holders have plenty of reasons to be optimistic about what's coming next.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah