Jed McCaleb, co-founder of Ripple, recently addressed the controversy surrounding his massive XRP sales, stating his approach was designed to be transparent to investors rather than harmful.

XRP Co-founder Denies Malicious Intent Behind Token Sales

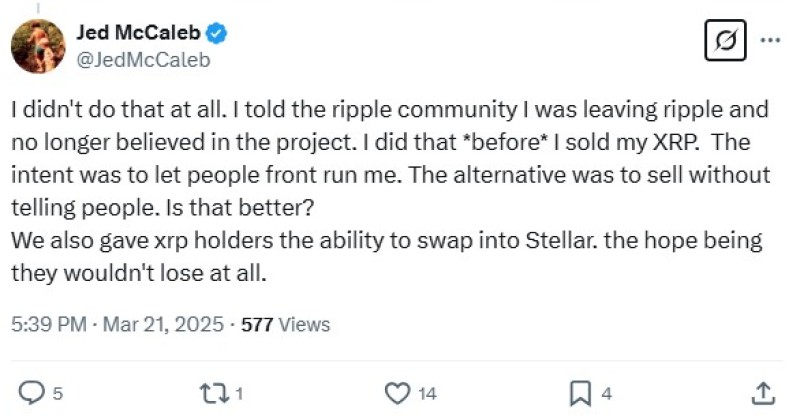

In a recent statement on X (formerly Twitter), Ripple co-founder Jed McCaleb defended his approach to selling his substantial XRP holdings. McCaleb explicitly denied allegations that his sales were motivated by personal grievances with Ripple's leadership decisions.

"The intent was to let people front-run me. The alternative was to sell without telling people. Is that better?" McCaleb explained in his post, emphasizing that his public announcement about leaving the company was intended to give the community advance notice of his planned sales.

$3.2 Billion in XRP Sales Funded Space Ambitions

McCaleb, who received 9 billion XRP tokens as a co-founder in 2012, has generated approximately $3.2 billion from selling his XRP holdings and company stake. This massive crypto fortune has recently been redirected toward an ambitious new venture - according to Bloomberg, McCaleb is now funding the development of the world's first commercial space station.

The 50-year-old entrepreneur, who also founded the now-infamous Mt. Gox exchange, left Ripple in 2013 after his vision for the project diverged from the company's direction. Following his departure, he co-founded Stellar, a competing blockchain project.

XRP Sales Agreement Evolved Through Legal Challenges

McCaleb's exit from Ripple wasn't without complications. In 2014, he reached an initial agreement with the company to gradually sell his tokens, with sales initially restricted to just $10,000 per week. However, Ripple later sued McCaleb, claiming he violated the terms by exceeding the contractual limits.

Following litigation, a new agreement was established in 2016 that tied McCaleb's XRP sales to the token's trading volume. This structured approach prevented a massive dump of tokens that could have potentially crashed the market.

Why McCaleb Avoided SEC Action While XRP Faced Scrutiny

In his recent statements, McCaleb also addressed why he wasn't targeted by the Securities and Exchange Commission (SEC) during their enforcement actions against Ripple. "I was never involved in promoting XRP as an investment," McCaleb noted, suggesting this distinction helped shield him from the regulatory scrutiny that Ripple faced.

As reported by U.Today, McCaleb finally depleted his XRP holdings in 2022, ending an eight-year selling process that had been closely watched by the crypto community.

Ripple CTO's Perspective on McCaleb's XRP Divestment

Ripple's Chief Technology Officer David Schwartz has previously offered his own perspective on McCaleb's selling strategy. According to Schwartz, McCaleb initially attempted to dump all his XRP tokens at once, but Ripple prevented this through legal intervention.

In a notably candid assessment on Quora, Schwartz quipped that McCaleb "will probably be the only person to become a self-made billionaire despite his best efforts," suggesting that the structured sales agreement ultimately benefited McCaleb financially more than an immediate sell-off would have.

The conclusion of McCaleb's XRP sales in 2022 marked the end of a chapter in Ripple's history, while his recent space station venture represents a significant pivot for the crypto billionaire's focus and investments.

Peter Smith

Peter Smith

Peter Smith

Peter Smith