Cardano (ADA) is back in the spotlight as large holders make bold moves. Whales have accumulated $2.33 million in ADA, signaling rising confidence in the asset’s near-term trajectory. The altcoin recently reclaimed the $0.59 support level and is now pressing against the $0.67 resistance — with growing speculation of a potential breakout.

Whale Accumulation Heats Up

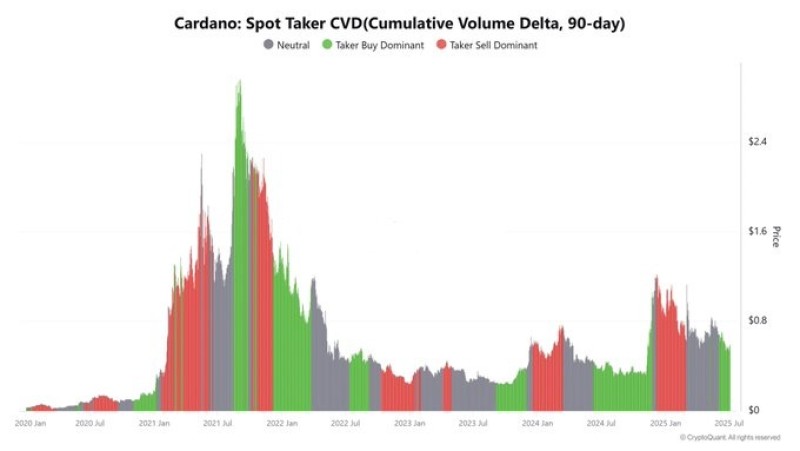

On-chain Cumulative Volume Delta (CVD) data provided by CryptoQuant paints a clear picture: taker buy volume is surging. The green zones on the chart show buy-dominant activity intensifying through 2024 and into mid-2025, mirroring past accumulation phases that preceded significant price rallies.

Erica Hazel notes that short-term holders are “fading out,” a historically bullish signal indicating a shift in supply from weak hands to long-term conviction holders. The $2.33 million withdrawal from exchanges reinforces this narrative.

Price Action: From Support to Launchpad?

Cardano (ADA) is currently trading above $0.59 and testing resistance near $0.67 — levels that coincide with prior distribution zones. A clean break above $0.67 could open the door to $0.91, the next key target mentioned by Hazel in her post.

Historically, similar setups in the CVD chart (notably in early 2021 and mid-2023) have preceded major upside moves. If momentum holds and whale accumulation continues, ADA’s price could accelerate quickly.

Conclusion

With whale activity rising and short-term holders exiting, Cardano appears poised for a potential breakout. A move past $0.67 could ignite a rally toward $0.91, especially if buyer dominance continues on the spot market. For now, all eyes remain on how ADA navigates the critical levels in the coming days.

Peter Smith

Peter Smith

Peter Smith

Peter Smith