Solana (SOL) recent price drop isn't scaring away smart money. While the token took a hit lately, investors see this as a healthy correction rather than any real weakness. SOL has been bouncing around its range after weeks of wild swings, and the buying activity shows people are getting bullish about a recovery.

Market data is looking pretty good right now, with momentum starting to shift toward a rebound. Technical indicators and on-chain metrics both suggest SOL might be gearing up for some upward action.

SOL Chart Shows Bulls Getting Ready

On the 4-hour chart, Solana's been forming a rising channel pattern that's held up for three months straight. The latest dip hit that lower trendline again but didn't break it – keeping the bullish structure alive. This setup is looking solid for a bounce, especially with sentiment starting to turn around.

The RSI just hit oversold territory, which usually means the selling is running out of steam. History shows that when things get this oversold, buyers often step in and push prices back up. If that pattern holds here, SOL could rally from where it's sitting now.

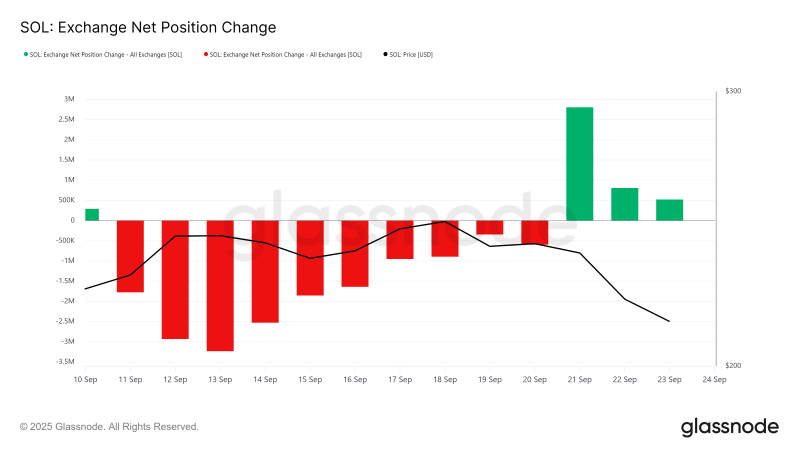

Looking at exchange data, the recent selloff was mostly panic selling – not smart money getting out. Short-term volatility spooked some folks into dumping their bags, but the market absorbed all that selling pretty well. That tells us confidence in Solana is still strong despite the price action.

In just the past 48 hours, buyers grabbed nearly 1.5 million SOL worth over $315 million. That's serious money flowing in, and it shows big players and institutions still believe in Solana's future. This buying wave has strengthened SOL's outlook and put a floor under the price.

SOL Price Targets: What's Next?

Right now, SOL is trading at $210 and holding above key support at $206. With the broader market stabilizing and money flowing back in, SOL looks set to defend that $200 level and keep climbing higher.

If momentum keeps up, Solana could break through resistance at $214 and turn $221 into new support. That would clear the way for a move to $232, giving SOL the fuel it needs for bigger gains.

But if the market gets spooked again, SOL might slip below that $206 support. In that case, we could see it test $200 or lower, which would break the current bullish setup and bring more downside pressure.

Usman Salis

Usman Salis

Usman Salis

Usman Salis