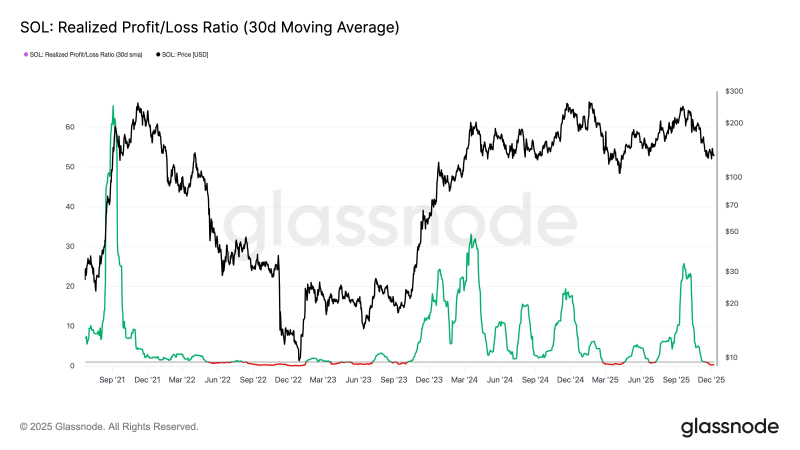

⬤ Solana's liquidity is thinning because its Realized Profit/Loss Ratio has fallen into the range seen during bear markets. The 30-day average has stayed under 1 since mid-November - traders across the network are closing more positions at a loss than at a gain. This marks a clear change in how the market behaves.

⬤ The Realized Profit/Loss Ratio serves as a simple gauge of liquidity. A reading above 1 shows that profit taking leads and liquidity grows. A reading below 1 shows that loss taking leads and liquidity contracts. At the moment Solana sits squarely in the loss dominated zone. The chart displays earlier cycles in which the ratio spiked for a short time before it dropped again, a pattern that matches the current move.

⬤ A phase dominated by losses is important because only a small share of participants will sell at a profit. The ratio turns positive only after new demand appears or after forced sellers leave. Neither event has taken place for Solana so far.

⬤ Tighter liquidity alters how Solana reacts to market moves. Low liquidity tends to produce sharper swings in either direction and raises volatility. The metric does not forecast price direction - yet it plainly reveals the trading conditions Solana confronts this day. For anyone who tracks the network, on chain liquidity signals stay crucial.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova