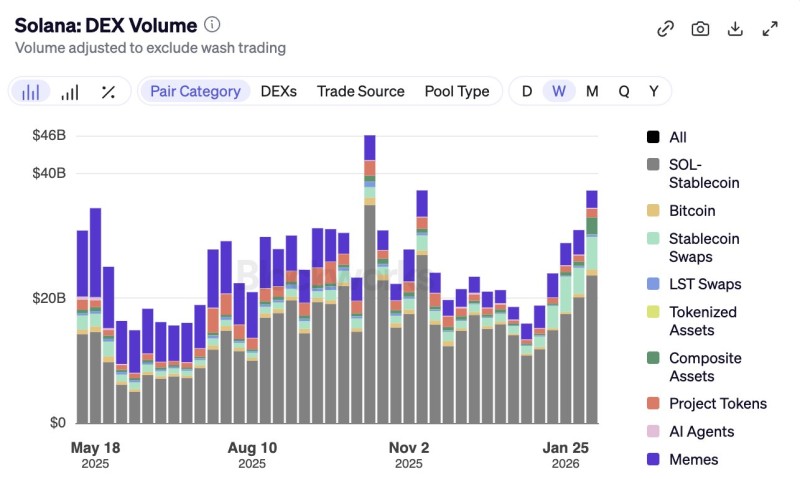

⬤ Solana's on-chain momentum is hard to ignore right now. Weekly decentralized exchange volume has reached roughly $37 billion — a six-week winning streak that's starting to look a lot like the network's November 2025 peak near $46B. The numbers suggest that actual usage isn't following the broader market's pessimistic mood.

⬤ Dig into the volume breakdown and it tells an interesting story. SOL-stablecoin swaps still dominate, but meme tokens keep punching above their weight in total transaction share. AI-related tokens show up consistently week after week, and project tokens hold steady participation. Taken together, it reads less like speculation and more like genuine ecosystem engagement — people are actually using Solana apps. For more context on where the price could head next, check out the Solana price outlook.

⬤ What makes this especially notable is the context. Bearish narratives are dominating crypto conversation right now, yet Solana is processing transaction volumes typically associated with bull markets. Multiple sectors — swaps, AI tokens, meme trading — are all contributing at once, which points to organic, broad-based activity rather than a single speculative spike.

⬤ The bottom line: rising usage metrics while sentiment declines is a meaningful divergence. Adoption here isn't being pulled along by price — the network is growing on its own terms. If that gap keeps widening, it may force a rethink of how the market measures strength across crypto ecosystems.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets