While most traders are dumping Solana (SOL) during this correction, long-term holders are doing the exact opposite. They're quietly loading up their bags, and this could push SOL back to $200 sooner than you think.

Why SOL Whales Are Buying the Dip

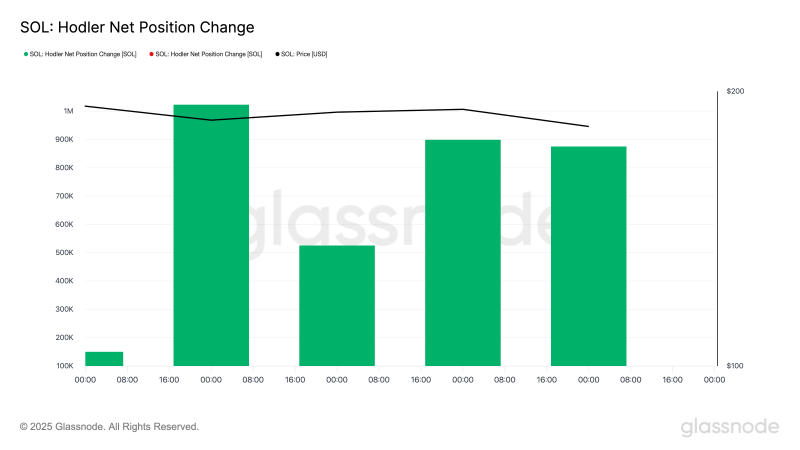

Something interesting is happening with Solana right now. While the price has been struggling, the smart money isn't panicking - they're accumulating. Data from Glassnode shows that long-term holders are treating this weakness as a golden opportunity to stack more SOL.

Here's the proof: SOL's Liveliness metric has been dropping steadily since August 16, falling from its peak of 0.7656. This shows that people who've held SOL for over 155 days aren't selling anymore. Instead, they're moving their coins off exchanges and holding tight.

When Liveliness drops like this, it means the smart money is accumulating while others are selling in fear. Even better - SOL's Hodler Net Position Change metric jumped by 64% between August 16 and 18. That's a massive spike showing these diamond hands aren't just holding, they're actively buying more.

Solana (SOL) Could Hit $200 If This Trend Continues

So what does all this whale accumulation mean? If these big holders keep stacking, we could see a quick bounce back. The first hurdle is at $195.55 - if SOL breaks through that resistance, the path to $200 opens up fast.

And $200 might just be the beginning. SOL could easily push toward that February high of $219.21 if the momentum builds.

The One Thing That Could Ruin the Party

But there's a catch. SOL's Chaikin Money Flow (CMF) is trending down, showing that fresh money is drying up. Even if whales keep buying, they need regular investors to join the party too. Without new money coming in, any bounce could fizzle out.

If accumulation can't attract fresh buyers, SOL might break below $171.81 instead. The smart money is betting on SOL's comeback, but they'll need the rest of the market to wake up and start buying too.

Solana (SOL) Could Hit $200 If This Trend Continues

So what does all this whale accumulation mean for SOL's price? If these big holders keep stacking, we could see a pretty quick bounce back. The first major hurdle is at $195.55 - if SOL can break through that resistance, the path to $200 opens up real quick.

And honestly, $200 might just be the beginning. Looking at the charts, SOL could easily push toward that February high of $219.21 if the momentum builds. That would be a sweet recovery from where we are now.

The One Thing That Could Ruin the Party

But hold up - there's a catch. SOL's Chaikin Money Flow (CMF) is trending down, and that's not great news. This indicator shows how much fresh money is flowing into SOL, and right now, it's drying up.

Here's the deal: even if the whales keep buying, they need regular investors to join the party too. Without new money coming in, any bounce could fizzle out pretty quick. If that happens and the accumulation can't attract fresh buyers, SOL might break below $171.81 instead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah