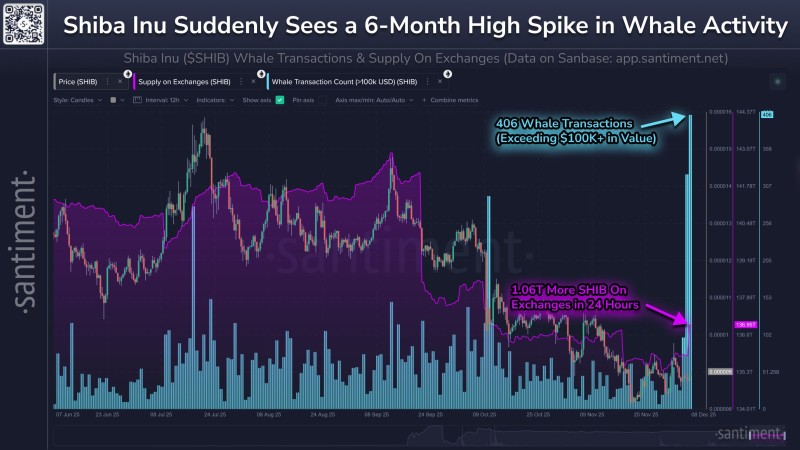

⬤ Shiba Inu experienced a dramatic jump in large-holder activity, with fresh on-chain data showing more than 1.06 trillion SHIB rushing onto exchanges in just 24 hours. These kinds of massive inflows typically hint at bigger price swings coming for SHIB. The data also reveals whale transactions hitting a six-month peak, fueling expectations that volatility could ramp up soon.

⬤ The numbers tell an interesting story: SHIB logged 406 whale transactions worth over $100,000 each—the busiest day for big moves since mid-2024. Meanwhile, exchange supply jumped to around 136.9 trillion tokens. When this much SHIB lands on exchanges all at once, it usually means major holders are either preparing to sell or repositioning their holdings, which tends to shake up prices in the short run.

⬤ Whale behavior has always been a reliable early warning system for liquidity shifts in SHIB. Right now, the combo of surging transaction counts and climbing exchange balances suggests traders should brace for choppier waters ahead. We've seen this pattern before—when whales get active, speculative trading heats up and price action gets wild.

⬤ Why does this matter? Because when large holders start moving billions of tokens around, it can quickly shift sentiment and liquidity across the entire meme-coin space. With SHIB's exchange supply climbing and whale activity at multi-month highs, the market's looking pretty sensitive to any additional large moves or sudden demand changes.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov