Ripple's stablecoin RLUSD is seeing some weird action - trading volume has tanked despite fresh tokens hitting the market after nearly two months of silence.

RLUSD Minting Finally Kicks Back Into Gear

After sitting quiet for what feels like forever, Ripple has finally started minting fresh RLUSD tokens again. The Ripple Stablecoin Tracker dropped some interesting numbers - we're talking about 19 million new RLUSD tokens that showed up over just 48 hours.

Here's how it went down: first, 12 million RLUSD got minted on June 13, 2025, then another 7 million followed in the early morning hours of June 14. What makes this really stand out is that before these two drops, Ripple hadn't minted a single token since April 25, 2025. That's a solid 49 days of absolutely nothing - pretty unusual when you consider how active the stablecoin space has been lately.

RLUSD Volume Gets Absolutely Crushed

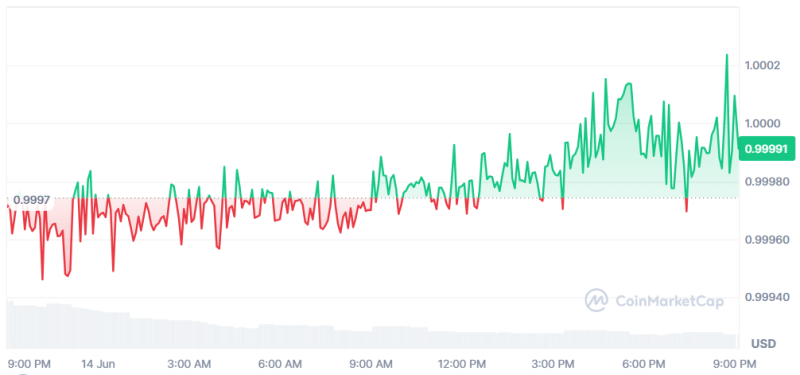

Now here's where things get weird. You'd think fresh tokens hitting the market would spark some trading action, right? Wrong. RLUSD trading volume just got demolished, falling a massive 68.96% down to $62.26 million. The new minting didn't seem to move the needle at all.

But honestly, RLUSD isn't alone in this mess. The entire crypto market has been having a rough time lately, with overall trading volume dropping 40.64% in just 24 hours. Big names like Bitcoin, XRP, and Ethereum have all been taking serious hits. It's one of those market-wide selloffs that makes everyone nervous, and even stablecoins like RLUSD - which people usually run to for safety - aren't getting much love.

Maybe Ripple's Playing the Long Game with RLUSD?

While the current demand for RLUSD looks pretty weak, Ripple might actually be making a smart move here. Think about it - minting 19 million tokens during a market downturn could be strategic positioning rather than bad timing.

The Treasury team might be looking ahead, knowing that when this market mess eventually sorts itself out, they'll need enough RLUSD supply ready to go. Once all the geopolitical drama calms down and crypto finds its footing again, demand for Ripple's stablecoin could bounce back hard.

It's classic "buy when there's blood in the streets" thinking, except Ripple's creating supply when nobody wants it, betting that appetite will return when conditions improve. Not a bad strategy if you're confident in the long-term outlook.

Peter Smith

Peter Smith

Peter Smith

Peter Smith