As technical traders turn their focus to emerging altcoins, Hyperliquid's HYPE token is drawing attention for a potentially bearish setup forming on its daily chart. A well-defined head and shoulders pattern—one of the most widely recognized reversal formations—suggests the asset may be on the verge of a significant trend change. If the structure completes, the move could indicate a deep correction in the weeks ahead.

Hyperliquid Chart Signals a Classic Bearish Reversal

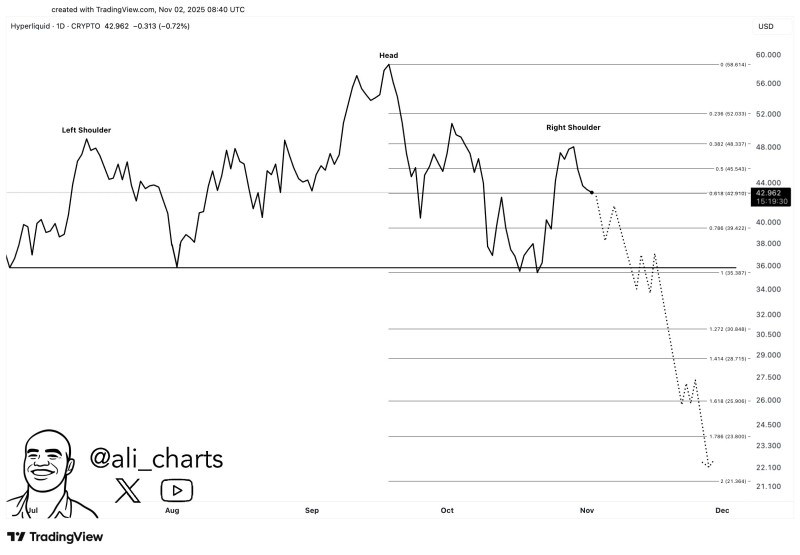

According to technical analyst Ali, the chart presents a clean head and shoulders configuration, with the left shoulder forming in late August, the head peaking around $58.6 in October, and the right shoulder failing near $48.3 in early November. The neckline support, drawn around $35.4, remains the critical threshold for this formation.

If HYPE closes decisively below this neckline, the projected downside measured from the pattern's peak could send the token toward the $20–$23 range, aligning with Fibonacci extensions between 1.618 and 1.786.

Pattern Breakdown and Key Support Zones

The structure highlights several important retracement and extension levels:

- The 0.618 level at $42.9 acts as the current resistance area

- The 0.786 level at $39.4 serves as initial short-term support

- The 1.0 neckline at $35.4 marks the key confirmation zone

- Extension targets include $30.8, $28.7, $25.9, $23.8, with a potential low near $21.3

If the neckline breaks, these levels could act as successive support zones where traders may attempt to re-enter or cover short positions.

Broader Market Context

The potential reversal in HYPE mirrors a broader cooldown across DeFi tokens, as liquidity consolidates into higher-cap assets amid weakening market momentum. The absence of strong buying volume and the symmetrical structure of the pattern suggest waning enthusiasm among bulls after an extended summer rally. Market sentiment has turned cautious, with traders watching whether HYPE can hold above the neckline or if a full technical breakdown will unfold.

Key Level to Watch

Should HYPE maintain its footing above $35, the pattern could still invalidate, allowing for a potential rebound toward $45–$48 resistance. Conversely, a sustained move below the neckline would confirm the bearish setup, opening the path to a deep correction toward $20 in the coming weeks. For now, all eyes are on the neckline—the line separating a routine pullback from a full-fledged trend reversal.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi