Ethereum has been regaining spotlight in the Layer 1 blockchain space with the looming update to version 2.0 and DeFi growing in popularity. Its price has behaved accordingly, even against BTC. Some people try to get into ETH through more traditional vehicles like Grayscale. However, this may be dangerous at this point.

Grayscale Ethereum Trust (ETHE) provides investors with exposure to Ethereum’s price without having to store actual coins. The securities derive their price from ETH and are backed by ETH held on Grayscale’s balances.

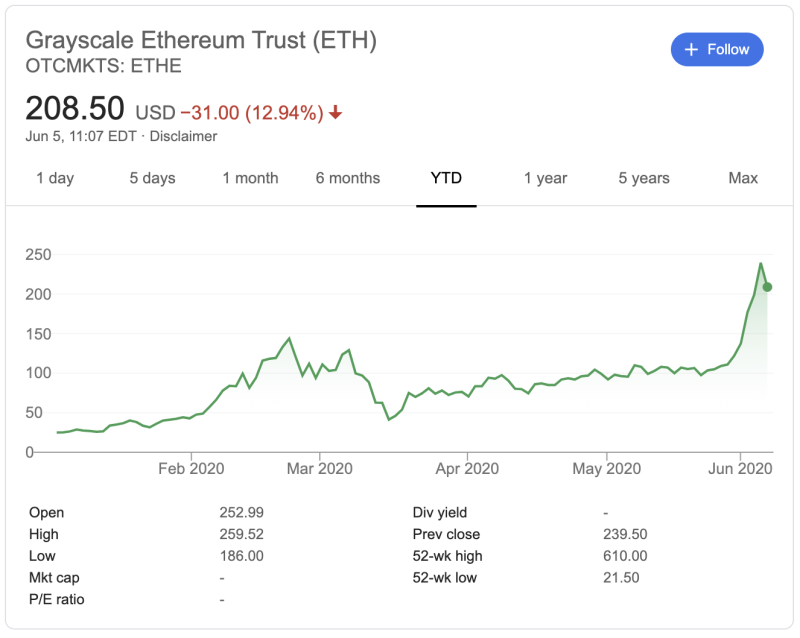

Larry Cermak, the Research and Analyst Director at the Block, recently tweeted his concerns about the growth of ETHE. His major gripe with the shares’ surge is that its price currently trades roughly 10 times higher than what Grayscale has under its management.

Some people from Ethereum’s community also highlighted ETHE’s rapid growth. One tweet pointed to the fact that the trust has 0.09400615 ETH per ETHE share. At this point, ETHE’s price is roughly $200.

There may have been confusion around retail inventors about what they were buying. Presumably, people were investing in ETHE, thinking that a single share accounts for 1 ETH. This may explain the rapid growth of the asset’s price to levels close to the real ETH price.

Currently, some of ETHE shares are locked, which contributes to the price remaining high. However, as Larry Cermak tweeted, the shares are likely to collapse shortly after the unlock. He summarized that ‘retail will get absolutely destroyed’.

Meanwhile, a similar event occurred with Grayscale Bitcoin Trust (GBTC). The shares also had a premium to the net asset value, but as the shares unlocked the premium didn’t completely vanish. Still, ETHE premium is orders of magnitude higher, pointing to a more substantial risk.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah