While most crypto investors focus on price charts and market sentiment, a quiet revolution is happening beneath the surface of Ethereum's ecosystem. Nearly one-third of all ETH tokens have been voluntarily removed from circulation, creating a supply crunch that's flying under the radar of mainstream attention. This isn't just another temporary market trend – it's a fundamental shift that could reshape Ethereum's price trajectory for years to come.

Record-Breaking Staking Numbers Signal Major Supply Shock

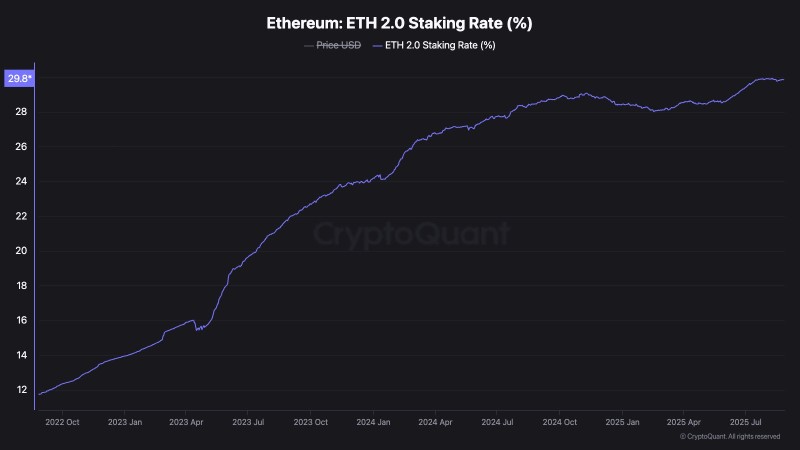

The numbers tell a compelling story that few are paying attention to. Ethereum's staking rate has quietly climbed to an impressive 29.8%, representing a massive jump from the modest 12% we saw back in late 2022.

Based on insights from analyst @genius_crypto_ and confirmed by CryptoQuant data, approximately 36 million ETH tokens are now locked away in staking contracts – that's nearly $90 billion worth of cryptocurrency completely removed from active trading.

This dramatic shift means that out of Ethereum's total 121 million token supply, almost a third is now earning staking rewards rather than being available for buying and selling. The implications are staggering: every day that passes, more ETH gets locked up, making the remaining circulating supply increasingly scarce.

Institutional Money Hasn't Even Arrived Yet

Here's where things get really interesting. All of these record-breaking staking levels have been achieved without any major institutional investment vehicles. The highly anticipated Ethereum Staking ETF is still waiting for regulatory approval, meaning we're seeing organic demand from individual investors and smaller institutions.

When that institutional floodgate opens, the impact could be explosive. Traditional investment firms managing trillions in assets would suddenly have a regulated, compliant way to gain exposure to Ethereum staking rewards. The resulting demand could push staking rates even higher, creating an unprecedented supply squeeze that could send ETH prices into uncharted territory.

The writing is on the wall – Ethereum is quietly building the foundation for what could be one of the most significant supply-driven rallies in crypto history.

Usman Salis

Usman Salis

Usman Salis

Usman Salis