Ethereum (ETH) faces a bearish trend as its price slumps, but the founder's prediction of $166,000 by 2032 sparks optimism.

Ethereum Turns Bearish

Ethereum (ETH) saw a downturn yesterday, signaling a potential continuation of the bearish trend. The coin encountered resistance at the $3,300 level, coinciding with the anchor bar of April 13, indicating a bearish trend continuation.

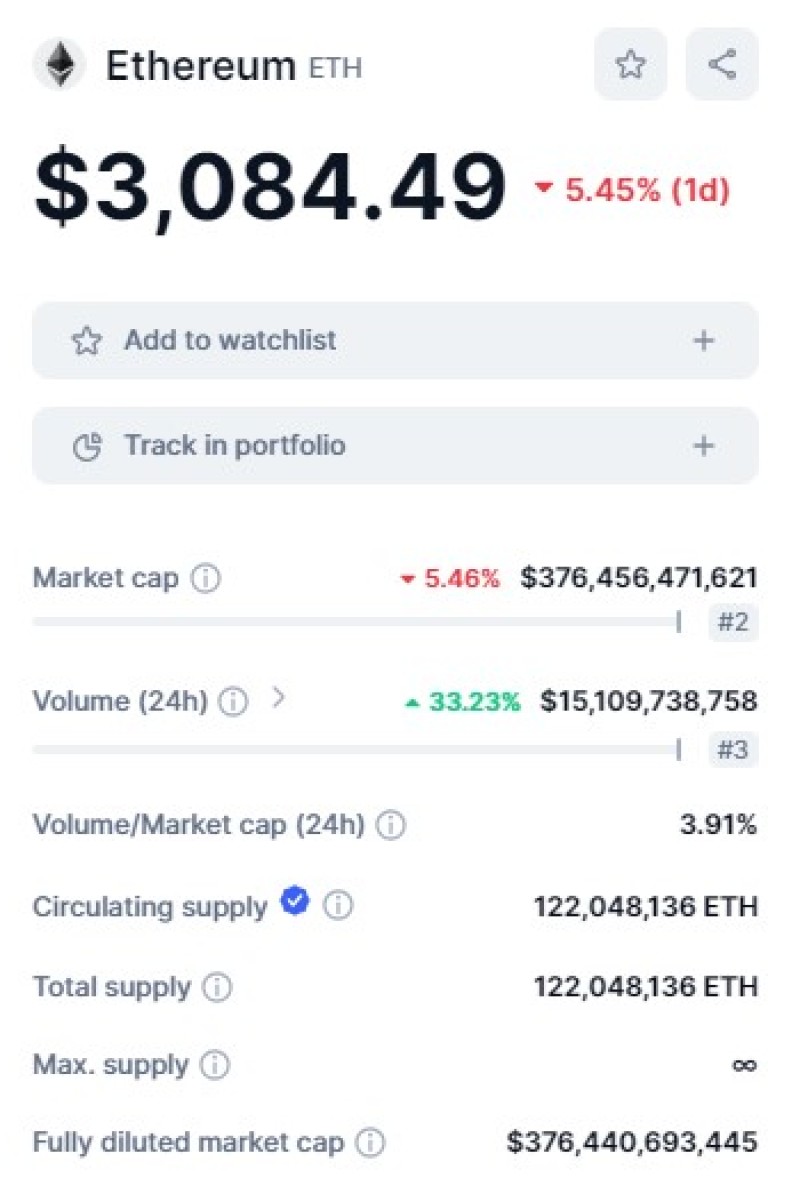

At present, Ethereum finds itself within a bear breakout formation, down by 3% in the last day while maintaining stability.

However, it recorded a 6% increase in the previous trading week. To shift momentum, bulls need to resist further price declines and inject strength with increased trading volume. Currently, the average trading volume in the last 24 hours stands at $15 billion, up by 30%, suggesting active selling pressure.

Positive Catalysts ETH Amidst Downtrend

Despite the downward pressure, positive developments in the Ethereum ecosystem offer some hope. With over 10 million active wallets connecting to Ethereum or its layer-2 platforms weekly, the network's utility remains strong. Additionally, Cathie Wood of Ark Invest expressed bullish sentiment, predicting Ethereum's market cap to reach $20 trillion by 2032, potentially driving the token's value to over $166,000.

ETH/USD, like other cryptocurrencies, continues its downward trajectory, with the path of least resistance pointing southwards. Traders remain optimistic for a reversal, with potential entry points below $3,300. However, a breakout above this level, accompanied by increased volumes, could invalidate the bearish outlook and signal a bullish reversal.

Conclusion

While Ethereum faces immediate bearish pressure, long-term optimism persists fueled by positive network developments and bold predictions from industry figures. Traders closely monitor key support and resistance levels for potential entry or exit points amidst the volatile market conditions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah