Dogecoin shows strong momentum this week while on-chain data reveals both buying pressure and some profit-taking from long-term holders.

Dogecoin has been the star of the memecoin space lately, and the numbers back it up. DOGE just wrapped up a solid 22% weekly gain that left other major memecoins in the dust. It's a pretty impressive showing that reminds everyone why this dog-themed token still sits at the top of the memecoin food chain.

DOGE Price Leads the Memecoin Pack

Right now, Dogecoin is crushing it with a massive $35.8 billion market cap, making it the undisputed king of memecoins. Compare that to Shiba Inu's $8.67 billion, and you can see just how big the gap really is. It's wild to think that community-driven coins like these are worth so much, but that's crypto for you.

This past week really showed DOGE's strength. While it posted that solid 22% gain, Shiba Inu only managed 12.5% and Pepe scraped together 8.7%. Sure, some smaller coins like Bonk might have bigger percentage moves here and there, but DOGE keeps proving it's the reliable heavyweight in this space.

The sustained performance isn't just luck either. DOGE has real community backing, widespread recognition, and growing real-world use cases that keep it relevant when other memecoins fade away.

DOGE Price Chart Shows Bullish Setup

Looking at the charts, DOGE is painting a pretty bullish picture right now. Trading volumes have been way above normal for the past ten days, which usually means something big is brewing. You can tell there's genuine interest from both retail traders and bigger players.

The key moment came when DOGE flipped that $0.196 level back into support and then made a run at the $0.25 resistance. It actually touched $0.257 before pulling back about 6.7% to $0.24, which is totally normal when you hit major resistance like that.

The RSI is still showing bullish momentum, though the money flow indicator suggests things might slow down a bit in the short term. For traders watching this space, the big question is whether DOGE can flip that $0.25 level into support. If it does, we could see a proper breakout above current levels.

DOGE Price Metrics Tell Two Stories

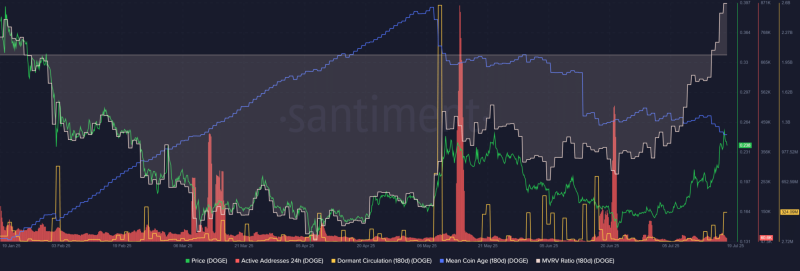

The on-chain data is telling an interesting story. Since May, more DOGE holders have been sitting pretty with profits, and that's led to some of the old-timers moving their coins around after months of just holding tight.

The MVRV ratio shows that people who bought in the last 180 days are up about 15% on average. That's nice profits, and it explains why we're seeing some selling pressure as people cash out gains. The mean coin age has been dropping, which backs up this profit-taking activity.

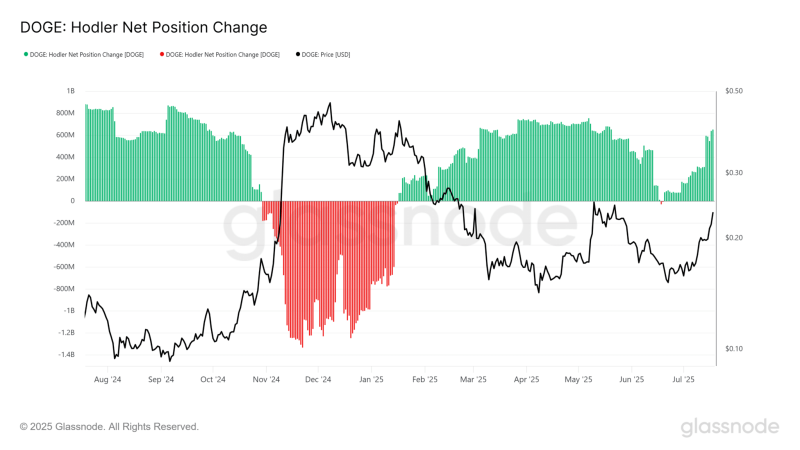

But here's the thing - despite some selling, long-term holders have still been accumulating throughout most of 2025. Yeah, it's slowed down recently, but the bigger picture shows people are still buying and holding for the long haul. That's usually a good sign for future price action.

The bottom line? DOGE needs to break above $0.25 and hold it as support to really get this rally going. If it can do that, we might see some serious upside in the coming weeks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis