Cardano (ADA) has entered a critical phase as large holders, known as whales, offload substantial amounts of ADA while the price attempts to consolidate below the $0.90 mark. Despite the heavy selling, the asset has shown resilience, sparking debate among traders about whether this signals healthy redistribution or a warning of further downside.

Large Holders Dump 140M ADA Tokens

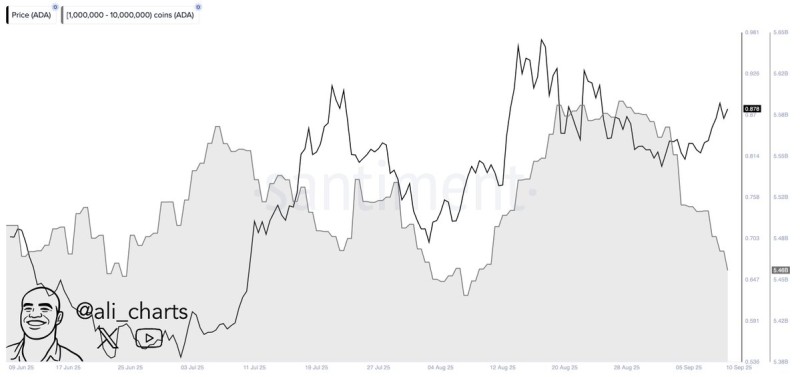

On-chain data reveals that whales holding 1 million to 10 million ADA coins have sold more than 140 million ADA over the past two weeks. Crypto analyst Ali pointed out this dynamic, warning that whale exits often act as a short-term ceiling for price growth.

This significant drop in holdings highlights a clear profit-taking trend among large investors.

Price Holds Steady Despite Heavy Selling

The data clearly illustrates a divergence between price action and whale balances. Whale holdings have declined notably since late August, as shown by the decreased accumulation patterns. Meanwhile, ADA's price has managed to stay relatively stable around $0.87, indicating that smaller buyers and new market inflows are absorbing some of the supply.

If selling pressure continues, ADA risks dipping toward the $0.78–$0.80 support zone. However, if accumulation resumes, resistance near $0.92–$0.95 could be retested.

What's Driving the Profit-Taking

Several factors could explain the current wave of profit-taking:

- ADA's rally since mid-August gave whales an attractive opportunity to realize profits

- Cautious sentiment across crypto markets encourages defensive positioning

- Whales may be reallocating into other assets with stronger short-term momentum

The current sell-off raises questions about ADA's near-term direction. While the price has held relatively steady despite whale selling, continued pressure from large holders could test lower support levels. Traders are watching closely to see if smaller investors can continue absorbing the supply or if broader market sentiment will shift.

Usman Salis

Usman Salis

Usman Salis

Usman Salis