After weeks of decline, Cardano has landed at a price level that's become almost legendary among ADA traders—$0.52.

The Pattern That Keeps Repeating

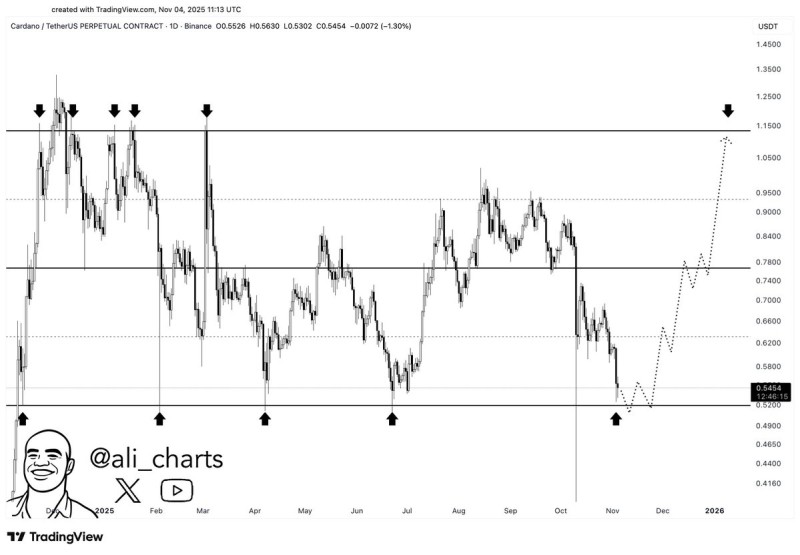

According to market analyst Ali, this support zone has held firm through multiple tests since late 2024, triggering rebounds each time. Now, with ADA hovering around $0.545, the big question is whether buyers will step in again or if we're finally headed for new lows.

The chart tells a pretty clear story. Every time Cardano has dropped to $0.52—in January, March, June, and now November 2025—it's bounced. Here's what the technical setup looks like:

- Strong support at $0.52 — tested multiple times, held every time

- Mid-range resistance at $0.78 — where rallies tend to stall out

- Major resistance at $1.15 — the ceiling that's capped every significant move this year

The dotted projection line on the chart suggests a potential path: a slow grind from $0.52 back toward $0.78, then possibly higher toward $1.00–$1.15. It's the kind of wave-like movement you see when a market is bottoming out and building steam for the next leg up.

What's Behind the Strength?

Despite the broader altcoin slowdown, Cardano has some things going for it. The network still ranks high in transaction volume and staking activity. DeFi projects on Cardano are growing, adding real on-chain demand. And historically, big holders—whales—tend to load up near this exact support level, often right before a bounce.

If $0.52 holds, the first target is $0.78. A clean break above that could bring momentum buyers back in and set up a push toward $1.00–$1.15. But if ADA loses this support? We could be looking at a drop toward $0.42–$0.45.

For now, the setup leans cautiously optimistic. The support has held before, on-chain activity looks stable, and the chart structure is predictable. If bulls can defend $0.52 one more time, Cardano might just be gearing up for another run.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah