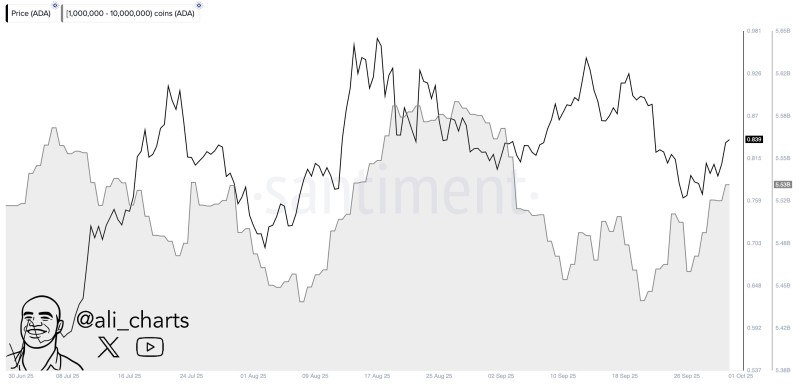

Recent on-chain data reveals significant whale activity in Cardano, with large holders adding substantial amounts to their wallets during a week of relative price stability. According to analyst Ali, whales purchased an additional 70 million ADA over seven days, pushing total holdings in the 1-10 million ADA wallet category toward 5.53 billion tokens. This accumulation occurred while ADA traded in a tight range between $0.80 and $0.84, suggesting institutional players are quietly building positions.

The timing and scale of this buying activity has caught traders' attention, particularly as it coincides with ADA holding support above $0.80 despite broader market uncertainty. Chart data confirms that whale balances have grown consistently, with each price dip met by increased accumulation rather than selling pressure.

Key Observations from the Data

The price has held relatively steady near $0.83 throughout this accumulation phase, maintaining support just above the $0.80 psychological level even during periods of volatility. Whale wallet balances have expanded in sync with price stabilization, showing a clear correlation between large holder confidence and market structure. Perhaps most tellingly, every meaningful price pullback has been met with expanded whale positions, indicating these investors are actively buying weakness rather than waiting for strength.

This behavior suggests sophisticated players are positioning ahead of what they perceive as a potential move higher, using current levels as an accumulation zone before the next leg up.

Why Large Holders Are Buying

Several factors likely explain this concentrated buying activity. Cardano's staking mechanism continues offering attractive yields for long-term holders, providing passive income while tokens appreciate. Ongoing development progress in Cardano's DeFi ecosystem and scaling solutions has strengthened fundamental confidence among institutional investors. Additionally, with ADA trading well below previous cycle highs, large investors appear to view current prices as a discounted entry point with favorable risk-reward dynamics.

The combination of yield generation, ecosystem growth, and depressed valuations creates a compelling case for patient accumulation at these levels.

What's Next for ADA?

If whale accumulation continues at this pace, ADA should maintain strong support around $0.80, giving bulls a solid foundation to push toward $0.90 in the near term. A clean break above that resistance could generate momentum toward the psychologically important $1 level, which would represent a significant technical milestone.

However, renewed selling pressure across crypto markets could test support at $0.75-$0.70. The critical difference this time is that whales are actively buying these dips, suggesting long-term players are already positioned for the next major move rather than waiting on the sidelines.

Peter Smith

Peter Smith

Peter Smith

Peter Smith